Q2 Closed Transactions | 16 Closed Transactions

Comments Off on Q2 Closed Transactions | 16 Closed TransactionsView our July Newsletter: Q2 Closed Transactions | 16 closed transactions with office being the leading sector.

View our July Newsletter: Q2 Closed Transactions | 16 closed transactions with office being the leading sector.

View our July Newsletter: Summer in Full Swing

CCIM Institute President’s Message | June 2024

Dear CCIMs,

Reflecting on last month’s accomplishments, I am incredibly proud of our continuous efforts as an organization and our CCIM community. From our most talked-about booth at ICSC Las Vegas to our Designees and candidates taking part in the REALTORS® Legislative Meetings in Washington, each step we take to further the industry it propels us forward in becoming the premier source for commercial real estate education and expertise.

I am excited for June because it marks the start of summer and the release of the summer issue of CCIM Connections magazine. This issue highlights the contributions of our members and chapters, showcasing their individual experiences and illustrating The CCIM Institute’s global influence on commercial real estate.

This month we are also gearing up for the C5+CCIM Global Summit, a partnership with the National Association of REALTORS® bringing the best and the brightest in the industry together, September 17-19 in Hollywood, Florida. This year’s event will feature keynote speaker Dan Marino, pro football Hall of Famer and legendary quarterback, as well as Tiffani Bova and Paco Underhill, experts in top-line growth and consumer behavior. Save on registration by taking advantage of the advanced rate, which ends Aug. 16.

What I am most excited to celebrate this month, though, is the launch of the CCIM Designee Marketing Campaign. This nationwide initiative aims to nationally recognize the value and strength that a CCIM brings to a deal. The campaign targets our allied partners, helping them understand the opportunities partnering with a CCIM can bring to maximizing client returns and investments. This three-year campaign will also provide valuable insights into how the Designation is perceived and understood in the marketplace and help us better position ourselves for the future.

As we look ahead at the second half of 2024, I always like to reflect on where I have been and where I am headed. As your Global President, I am proud of the progress we’ve made the first half of this year and excited for the opportunities that lie ahead. Thank you for your support and commitment to being a member of The CCIM Institute.

Sincerely,

D’Etta Casto-DeLeon, CCIM

2024 Global President

The CCIM Institute

View our June Industry Newsletter: Office Offerings

View our June Newsletter: Healthcare Expansion and Prime Opportunities

View our May Industry Newsletter: Land/Development Opportunities

View our May Newsletter: Spring Promo / Gala Events / and a New Team Member

View our April Newsletter: Q1 Closed Transactions | 24 closed transactions with office being the leading sector.

View our April Newsletter: Lending a Help Hand

View our March Industry Newsletter: Unlock Opportunity Industrial Properties

View our February Industry Newsletter: Fall in love with the Retail / Restaurant space of your dreams

View our February Newsletter: Top 10 Closed Transactions / Reward Trip

Reward Trip 2024 – Bahamas

Each year, Black Diamond Realty provides an incentive trip intended to reward team members who meet individual and company goals. 2024’s destination was Paradise Island of the Bahamas. The six days included lots of sun, playing beach volleyball, endless beverages, exploring the shops over at Atlantis and so much more! Our team returned to Morgantown recharged and excited for another successful year.

Black Diamond Realty has created a family-like, teamwork-oriented culture in which our team is vested in each other’s success. Our process is detailed and diligent but it surrounds core values and beliefs that are summarized by the acronym, HIT. “ H ” stands for honesty, hard work and humility. “ I ” stands for integrity, intelligence and innovation. “ T ” stands for teamwork, tenacity and technology. Maintaining a consistent focus on honoring our HIT value system, BDR’s team works tirelessly to achieve our clients’ goals. Recharging the battery is paramount to providing a high level of service.

Thank you to all our clients and referral sources for trusting us with your projects. Check out some of our favorite moments below.

View our January Industry Newsletter: Now is the time to Invest

View our January Newsletter: Reflecting and Projecting

As humans, it is natural for us to take things for granted. Our children will stay young forever. A business will continue on its current growth trajectory. 2023’s rapidly changing interest rate environment served as a reminder that things can change quickly. On March 17, 2022, the federal government set out to slow down an economy that was growing at an unsustainable rate. The federal funds rate rose from 0.25% to 0.50% in March 2022 to 5.25 to 5.50% on July 26, 2023 which represents the last rate hike (https://www.forbes.com/advisor/investing/fed-funds-rate-history/). That’s 500 basis points in 16 months! Rapidly increasing the federal funds rate achieved the government’s goal of slowing inflation. The speed of change was rapid, being the fastest in multiple decades, and sent shock waves throughout the commercial real estate world. Some of Black Diamond Realty’s observations are captured in the bullet points below.

2023’s theme was rapid change. What will 2024 look and feel like? Predicting the future is impossible, but national trends and experience allow us to make educated guesses. Please bear in mind you should always complete your own due diligence before making an investment decision. Black Diamond Realty’s 2024 predictions are as follows:

We often joke Black Diamond Realty is not a group of magicians. We are skilled CRE professionals whose job is to maximize exposure, navigate complicated processes and provide sound consultative investment and decision-making guidance based upon experience. We are in the commercial real estate trenches every day. We do not sell homes.

Diversifying investments, pursuit of passive income, filling a void in your portfolio’s performance (leasing) and liquidating an asset to meet long-term goals are all reasons to contact our Black Diamond Realty team. Call our team of experts today to set up a consultation. We look forward to serving you in 2024 and beyond.

Article by:

David Lorenze, CCIM Principal, and team.

View our November Newsletter: New Team Member for Martinsburg

View our November Newsletter: Black Diamond Realty’s Customized Process

It’s highly unlikely to win a game of pool just by hitting the break. Likewise, closing a commercial real estate transaction takes planning and careful execution. At Black Diamond Realty, we understand the uniqueness in every property we market, in every deal we secure, and in each client we serve. That attention to detail is not unlike that in the game of pool, where each shot must be meticulously designed according to the terrain of the felt, the balls in play, and the pockets.

The Black Diamond marketing team works diligently from the start to create custom flyers, engaging posts on various social media platforms and other marketing efforts to advertise our clients’ assets. We provide our agents with an arsenal of materials so they can be proactive in seeking the right tenants or buyer for their location. With each marketing presentation, we craft a story that appropriately aligns with our clients’ goals and promotes the attractive elements of their assets. These exclusive, personalized marking presentations are critical as we reach those in our local market in addition to tenants and investors outside of the north central West Virginia and eastern panhandle communities, through nationally recognized CRE marketplaces like LoopNet and CREXi.

The talented individuals on our marketing team have a combined 13 years of experience in the real estate industry and 23 years of experience in advertising and design. When it comes to marketing our clients’ assets, we sink the eight ball every time.

Quarter 3 resulted in 21 closed transactions with industrial being the leading sector amongst all completed deals. –> See Full List

Black Diamond Realty is celebrating its 10th anniversary – an occasion to celebrate and reflect. Ten years of successful service, dedication, and growth is a testament to our firm’s foundation, team, clients, innovation, culture, and communities. It has not been easy, yet we embrace challenges as learning opportunities, which lead to refined processes that better serve our constituents. Theodore Roosevelt said, “Nothing in the world is worth having or worth doing unless it means effort, pain, difficulty…”

The firm’s growth has been organic, strategic, and partnership based. Our team prides itself on continual learning and innovation, all while staying true to our core principles rooted in integrity. Black Diamond’s model delivers high-quality client service and authentic connections within our communities.

Reaching the 10-year milestone is thrilling. We look forward to raising the standard and elevating expectations, over the next decade. On that note, let’s highlight ten of Black Diamond’s elements for success.

Presentation

We do it the best. Our three in-house graphic designers deliver exceptional presentations for every property. We work to craft marketing materials that align with our clients’ goals and make their assets shine.

Process

We are proactive. We use market data and analysis to brainstorm appropriate buyers/tenants for a project and actively pursue them.

People

Black Diamond’s team is the difference. Each Associate and marketing professional is comprehensive, committed, customized, and connected. Teamwork is at the core of our culture and instilled within our playbook for success.

Values

Black Diamond’s mission is instilled with HIT: H stands for hard work, honesty, and humility; I stands for integrity, innovation, and intelligence; T stands for trust, teamwork, and tenacity.

Mission

Our mission is to enhance the well-being of individuals and communities through our team’s service and by empowering clients to achieve great success in both their professional and personal lives through commercial real estate opportunities.

Vision

Be the dominant commercial brokerage firm in the region, all while embracing our core competencies, focusing on our formula for success, and providing unparalleled service.

Comprehensive

The Black Diamond team delivers on every angle by taking a detailed approach to achieving our clients’ goals.

Committed

The Black Diamond team is dedicated to service that ensures the success of our clients and community.

Customized

The Black Diamond team designs personalized plans, based on client and community needs, to provide the highest level of service.

Connected

The Black Diamond team possesses a unique network of resources that continues to grow through community involvement, contribution, and transforming developments.

Thank you to our clients! We treasure our relationships and understand they are built upon trust, transparency, and dedication. Cheers to triumphs we have experienced with you and to the success we pledge to achieve in the years ahead!

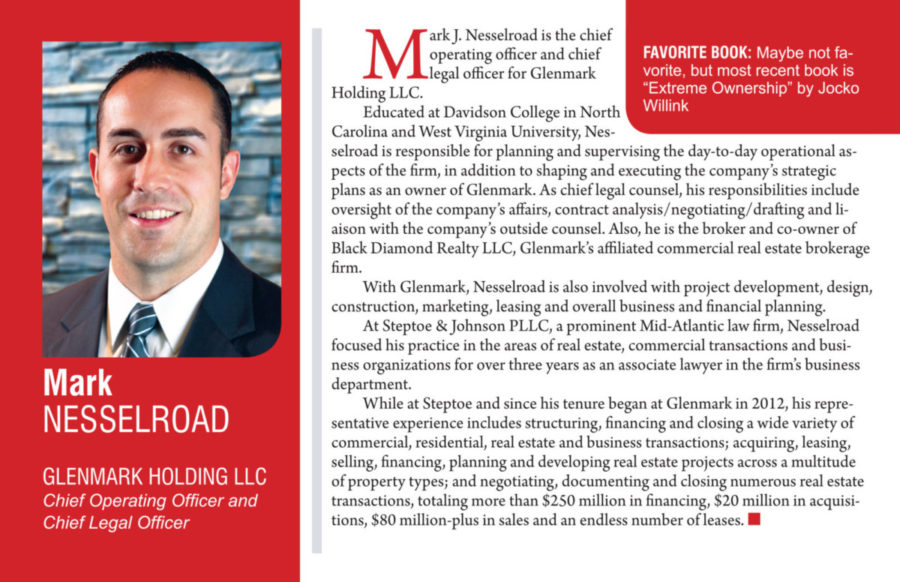

Article written by: Mark J. Nesselroad, Broker

Black Diamond Realty is proud to be celebrating ten years of excellence! It’s hard to believe that a whole decade has passed since we’ve first opened our doors in October of 2013. According to trends by the U.S. Bureau of Statistics, only 30% of small businesses survive to celebrate their 10th year in business. Double digits takes a talented team focused on providing value to the people and communities it serves. We are thrilled to be part of the communities we serve and are excited to continue growing for years to come.

Check out our Newsletter by clicking the link below:

View our September Newsletter: Black Diamond Realty Will Quarterback your Deal Across the Goal Line

Black Diamond Realty Will Quarterback your Deal Across the Goal Line

Every successful football team is led by a quarterback. Quarterbacks think on their feet, capitalize on the strengths of their team, call audibles when necessary and read and anticipate the defensive strategies of the opposing side, all with one goal in mind: getting into the end zone. Commercial Real Estate (CRE) transactions, both simple and complicated, need a strong quarterback to get deals across the goal line.

Much like a defense on a football team, some ‘defenders’ are both working directly against you while others are working to protect their own interests.

Defensive Team in CRE

Safeties – Time and Regulations

Line Backers – Zoning, Inspections and Utilities

Cornerbacks – Financing and Legal Issues

Defensive Ends – NIMBYs (Not In My Back Yard) and Surveys

Defensive Line – Sellers and Buyers

A good quarterback will assist you with the challenges that arise during a touchdown drive. Reading the safeties before the play, calling an audible when the line backers are lined up staring you down, checking down to your 2nd and 3rd wide out when the corners are in position to shut you down, nimble enough to escape the defensive ends when they blow past your lineman, and most important keeping the defensive line from blowing up your play or drive with a sack or tackle for loss.

With over eight years of experience and wisdom, I have quarterbacked dozens and dozens of deals across the goal line. I have seen that you not only need a winning quarterback to consistently lead a championship team, but the team he plays for needs to have a winning culture like Black Diamond Realty. Very few deals have lined up like ‘the perfect play’ where everyone maintains their assignment, the perfect pass is thrown and caught for a 65 yard TD. Reading the challenges that lay ahead, thinking on my feet, directing receivers where to go is what separates a championship quarterback from one who is just good enough to be there.

Black Diamond Realty has the experience and expertise to help navigate your commercial real estate deal, play-by-play, first down after first down, to get across the goal line. We offer a championship caliber lineup of top-notch quarterbacks that design winning game plans and ensure successful transactions while leading with a winning attitude. As another exciting season of college football is upon us, Team BDR is suited up and ready to lead you and your team to a win on the field of commercial real estate.

Contrary to popular belief, there are quite a few differences that ultimately affect the outcome of your real estate journey. David Lorenze, Principal at Black Diamond Realty, and Melissa Hornbeck, Broker of White Diamond Realty, sit down to answer some important questions that help differentiate the two.

While anyone in the state of West Virginia who takes the real estate exam can practice both commercial and residential real estate, we believe there are a number of large differences between the two and that it takes specialized expertise to navigate the two fields

Having Black Diamond Realty to specialize in commercial real estate, and White Diamond Realty to specialize in residential real estate, means that each of our teams can focus on honing their skills to give our clients the best possible service no matter what side of the table they’re on.

View our August Newsletter: Love all, Serve all

Love all, serve all.

I started playing tennis with my parents at a very young age. It was a way my family and I spent time together as well as with other friends and neighbors in our community. In the game of tennis, both players begin with a score of ‘love.’ To start a game, one player serves the ball to the other player, then the volley back and forth begins. Negotiating a commercial real estate transaction has similarities to a tennis match. One party must ‘serve’ an offer to the other, then the volley back and forth begins. Also like in the game of tennis, a good commercial real estate professional seeks information to learn about their opponent and their strengths and weaknesses. This informs the delivery of the initial serve (or offer) and the anticipated reaction. This helps when ‘serving’ an offer on a property.

I recently played the negotiation game for a new business in Morgantown. This retailer has over 29 locations nationwide where they provide the ultimate shopping experience and a unique selection of clothing and merchandise for the entire family. They have now grown to become the hometown college store for some of the greatest fan bases in the country. I knew they would be perfect for one of our most popular shopping centers here in Morgantown. My client and I worked together to come up with the perfect initial ‘serve’ to start the negotiation game. We went back and forth with the landlord several times before we landed on terms that worked for all parties involved. My client is set to open their doors the first weekend in September so they can ‘serve’ WVU football fans for the first home game.

‘Love all, serve all’ is actually the Hard Rock Café slogan, but it has always reminded me of tennis and how all players begin their match on equal ground. To the Hard Rock Café, the slogan represents their commitment to embracing diverse communities and to promote health, wellness, and environmental sustainability throughout their regions of operation. Similarly, Black Diamond Realty works to embrace and understand our community to serve all of our clients with love.

View our July Newsletter: Life is a marathon, not a sprint.

Life is a marathon, not a sprint.

In the daily race of my life, I often think about the famous idiom; Life is a marathon, not a sprint. As an active runner, I appreciate the connection to the various cadences it describes. As a commercial real estate professional, I appreciate the reassuring motivation it brings to ‘staying the course.’ Regardless of whether you associate the adage with mental or physical navigation and speed, being reminded of the importance and payoff of patience and persistence is always reassuring.

Navigating a successful commercial real estate closing or sale often brings twists and turns, complicated scenarios, and unexpected lane changes. These hurdles and the obstacle course of the deal are an exciting challenge for me, as I maintain patience in pursuit of the goal on the horizon. As with any race that I begin training for, I study the course, understand the terrain, and build a roadmap of my training schedule, all with the end in mind. I do the same with my work in commercial real estate closings. As a committed commercial real estate professional, part of my job is to assess the course, to learn, understand, and anticipate the hurdles, and to persevere under pressure. This commitment to time, talent, and patience is what sets me and our BDR team apart from others running the race.

Recently, we successfully negotiated the sale of a property that was near and dear to my heart. This client was my first client upon joining Black Diamond Realty over three years ago. The client and I became very close, so much that my week didn’t feel complete if I hadn’t spoken to her. The property she wanted to sell was a very specialized asset and was going to take a buyer that was ‘just right.’ We actively marketed this property for nearly three years. We utilized letter campaigns, targeted marketing, postcard campaigns, cold calling, carrier pigeons (just kidding)— you name it, we did it! When we finally found the perfect buyer, the fun really began. Getting the purchase agreement signed was the first hurdle of the deal and getting to the finish line was a true test of patience and endurance.

After ten months of perseverance, the property changed hands. Time has shown me that when things pop up on appraisals or inspections, it is important to be patient, to stay the course, and to continue to push forward to find a successful resolution. When the dust finally settled and we closed on this sale, we achieved our clients’ goals AND the buyers’ goals as well. This is what we strive for with all of our transactions.

Every property is different. Every transaction is different. Every race is different. However, there is always a path that ends at the finish line and Black Diamond is the commercial real estate team that knows the way. Have our team join you on your next commercial real estate journey, your next race. No matter the distance, we know how to stay the course and get you to the finish line.

View our June Newsletter: The “HIT” Approach to Success

Building a Winning Strategy: Black Diamond Realty’s “HIT” Approach to Commercial Real Estate Success

As one of the newest Black Diamond Realty (BDR) members, I am proud to step up to the plate and be part of a team that embodies the core values of Honesty, Integrity, and Teamwork. In the game of commercial real estate, these values are the foundation of our success. And in the game of baseball, where every “HIT” counts, Black Diamond Realty delivers exceptional results for our clients. Our commitment to “HIT” positions us as the finest choice for commercial real estate services in West Virginia and Southwestern Pennsylvania. Allow me to share a few personal experiences that illustrate how the power of “HIT” has boosted us to consistently achieve success for our clients.

Stepping Up to the Plate with Honesty

In my journey as an agent at Black Diamond Realty, I quickly learned that honesty, with my team, our clients, and myself, is the first base of trust. It is stepping up to the plate and facing the pitcher with unwavering confidence. Early in my career with BDR, I recall a situation where I was representing a buyer who had recently sold his businesses and wanted to 1031 exchange into a relatively passive multitenant retail investment property occupied by a strong national tenant that seemed promising on the surface. However, after conducting thorough research and analysis, I discovered potential pitfalls that the client was unaware of, including a broad restrictive covenant in the national tenant’s lease that could have severely impacted the ability to lease other vacancies in the future. Just like a batter recognizing a curveball, I quickly adjusted my approach. I was upfront with the client and explained my findings, even though it meant advising against the investment and the potential for a substantial commission. This transparent approach solidified the trust between us and set the groundwork for our next ‘at bat’ together.

Covering the Bases with Integrity

I represented a client in the sale of his mobile home park recently. He relied on me to deliver on multiple tasks that were outside of my position as an agent but vital for the deal to progress. Just like a pitcher covers first base on an outside ground ball, I committed to upholding the integrity of my role and our team with my reach of strategic planning, transparent communication, and dedication. I maintained professional integrity and the integrity of the deal by building trust, fostering positive outcomes, and nurturing long-lasting relationships. At Black Diamond Realty, we embrace integrity as our winning strategy, ensuring that we pitch a perfect game by upholding our commitments and going the extra mile for our clients.

Hitting a Grand Slam with Teamwork

By collaborating with a diverse group of professionals, we unite unique talents and perspectives to establish a culture of success, a culture of hitting grand slams for our clients. In a recent project, our team resembled a well-coordinated infield, smoothly offloading a complex investment portfolio. We covered every angle and anticipated every opportunity. By knowing each team member’s strengths, we were able to quickly divide roles and strategically adjust our playbook for this opportunity. Through consistent communication and scheduled scoreboard reviews, our team was able to track the progression of the deal, troubleshoot challenges, and hold each other accountable. Everyone proactively took charge of their role and played their position flawlessly, from prospecting to due diligence and closing. Together, we hit a grand slam for our client, surpassing their expectations and showing the power of teamwork in achieving real estate victories.

In baseball, every hit has the potential to change the game; and although HIT carries a different meaning with Black Diamond Realty, it also reflects our team’s winning strategy. As an associate at Black Diamond Realty, I have witnessed the power of “HIT” in action. It is evident that through our commitment to these core values, we consistently deliver exceptional results for our clients. Step up to the plate with Black Diamond Realty and together as a team, we will swing for the fence.

View our May Newsletter: How Are Golfing And Commercial Real Estate Similar

Black Diamond Realty is like a seasoned golfer who consistently hits the fairway and sinks putts. And, like in the game of golf, our team’s unique approach and execution ensures successful commercial real estate transactions. This experience ‘swinging’ has delivered nearly 600 ‘holes in one’ as we approach a decade of service to the industry.

Do you think a course record could be secured using only a nine-iron and an old ball while wearing a tuxedo? Of course it couldn’t! Even if the tuxedo got a few good laughs, the golf pro probably would not invite you back to play anytime soon. Seasoned golfers typically use 14 different clubs, shoes with spikes, tees, a golf glove, high quality balls and proper attire that facilitates effective movement in given weather conditions. This level of detail and preparedness is like BDR’s approach to real estate deals. Our equipment includes seven dedicated associates, three fulltime graphic designers and a partnership with Glenmark Holding that combines decades of experience, leadership and service.

A first-time a golfer meets unexpected challenges navigating unknown courses, like a pesky oak tree with a low hanging branch on hole 11 or a water hazard at the edge of a sloping green on hole 17. An experienced golfer calls on previous games having navigated these hazards and can predict and adjust their game accordingly. The BDR professionals draw on their past experiences just as an experienced golfer does, while recognizing that every course, every project and every client is unique. Tiger Woods is one of golf’s most elite players because he practiced golf consistently from a very young age. He didn’t dedicate his mornings to tennis and afternoons to golf. He was committed and all in to his one sport. The same holds true for Black Diamond Realty. We are 100% focused on commercial real estate transactions.

The best golfers in the world are reflective and always finding ways to improve their game, saying things like, “I’m working on my grip, my posture, my tempo.” Similarly, you will find the best commercial real estate associates saying, “I’m networking and building relationships, writing my notes, making calls and setting goals”. In both cases, working on the fundamentals is a key to successful outcomes. BDR is your dedicated team for commercial real estate that brings the proper tools, experience, and drive to achieve your next ‘hole in one.’

Over a decade ago I started working in the commercial real estate profession. Starting something new was exciting and intimidating all at the same time. The same sentiment held true when I adopted golf as a new hobby two years ago. While I wanted to be an expert on my first day playing a round, it became painfully evident that success on the course would take practice to perfect my skills.

Knowledge and experience are very important for both business and golf. In business, it’s important to have a deep understanding of your industry and customers, as well as experience in managing expectations and making strategic decisions. In golf, knowledge of the game and experience with training and practice can help develop skills and improve performance. Another area of focus is relationships.

Several years ago I worked with a church that was new to town and looking to establish a presence. We identified a relatively small office space for their administrative needs and they proceeded to lease temporary space on Sunday mornings for their services. Fast forward three years later and we collaborated again to secure a 15,325-sf facility with an associated 10-year lease. Fostering positive relationships support success for everyone involved.

During my 12 years of experience as a commercial real estate professional, I have developed a deep understanding of the industry, market trends, and customer needs. This has allowed me to build strong relationships with clients and provide them with personalized and effective solutions for their commercial real estate needs. Additionally, my experience has helped me develop exceptional negotiation and communication skills, which are vital in closing deals and ensuring client satisfaction. And while my golf game is still developing, I am confident that my developed skills and strategies in commercial real estate can help you score a ‘hole in one.’

View our April Newsletter: How Are Skiing And Commercial Real Estate Similar

Could you imagine going to the top of a 10,000-foot mountain in shorts and a t-shirt to attempt your very first ski run? That experience would be chilling and potentially dangerous to your health without the proper equipment and experience. Navigating a challenging commercial real estate deal can have similar consequences to your long-term financial health. Just like a mogul on the slopes, real estate deal challenges require swift problem solving and action to successfully navigate the course.

Full-time commercial real estate agents have market knowledge, deal mechanic experience and essential specialty contacts to avoid and navigate the moguls of the commercial real estate world. Attempting to “save a few bucks” on real estate fees may be tempting for some, but often results in a more costly and frustrating end. Traversing the path without experience and proper equipment is risky, so make sure one of your success strategies is teaming up with the right commercial real estate firm to help you navigate a successful deal.

Two recent examples of deals, filled with moguls and challenges, are highlighted below. Spoiler alert: the deal that secured a west coast, 1031 buyer for a second-generation industrial building navigated their moguls with a commercial real estate team of experts.

Black Diamond Realty received a call from an owner who bought a multifamily property roughly 18 months prior to the conversation. Black Diamond had no involvement in that decision/deal. The investor leveraged most of their personal home’s equity to purchase the multifamily property. The assets were located in a strong submarket but the history and ongoing operations were challenging. Since purchasing, the property owner explained they had battled rent delinquency, criminal activity and property damage. Performance was weak. Deferred maintenance was abundant. The tenant situation was challenging.

BDR was asked if they could sell the asset for around the same value that the current owner paid. As part of its due diligence practices, BDR prefers to review three years of profit and loss statements and a current rent roll. Utilizing the income approach to valuing assets, the BDR team can relatively quickly determine a value range they feel is achievable based on current market and property-specific dynamics. After receiving financials, BDR respectfully explained they overpaid and that the current market could not bear their valuation. Black Diamond Realty declined marketing this property.

A long-time client charged Black Diamond Realty with finding a tenant for their recently vacated industrial building. BDR designed a comprehensive professional marketing flyer then maximized exposure via all commercial real estate digital platforms, including its company newsletter (current audience ~6,200). The BDR team proactively reached out to companies who previously expressed interest in similar-size assets and brainstormed end users then pursued them. After entertaining about a dozen tours, the team found the right fit – a company with over 100 locations willing to sign a 5-year lease.

BDR team members led conversations and negotiations on tenant build-out, including amortizing cost over the initial term of the lease. The seller had a long-standing CRE attorney relationship in this case, but BDR typically supports that step as well. BDR reviewed the draft lease and corresponding tenant comments with their client and after several months, secured a 5-year lease with a well-respected company.

Due to other projects and the desire to redeploy capital, the client mobilized BDR immediately to sell the 5-year lease to an investor. Following the same marketing process, the asset was presented as an investment opportunity. BDR secured a 1031, west coast buyer and worked with their broker to navigate questions and concerns throughout the due diligence process. In the end, all parties achieved their goals.

Don’t navigate the slopes alone. Trust the experts. Reach out to Black Diamond today to equip yourself with professional experience, tools, and service for your next deal. The BDR team will provide the advice, contacts, and market knowledge to successfully navigate your next black diamond (ad)venture. Cheers to continued economic growth in a changing investment landscape!

View our March Newsletter: New Agent, New Offerings & Our Reward Trip

Reward Trip 2023 – Aruba

On February 6th, the BDR crew departed for their 2023 Reward Trip to One Happy Island, Aruba! The team spent six amazing days in the sun together making memories and reenergizing for the busy year ahead.

Black Diamond Realty has created a family-like, teamwork-oriented culture in which our team is vested in each other’s success. Our process is detailed and diligent but it surrounds core values and beliefs that are summarized by the acronym, HIT. “ H ” stands for honesty, hard work and humility. “ I ” stands for integrity, intelligence and innovation. “ T ” stands for teamwork, tenacity and technology. Maintaining a consistent focus on honoring our HIT value system, BDR’s team works tirelessly to achieve our clients’ goals. Recharging the battery is paramount to providing a high level of service.

Each year, Black Diamond Realty provides an incentive trip intended to reward team members who meet individual and company goals. 2023’s destination was the island of Aruba. The team soaked up some much needed sun at the ocean front Riu Resort. The six days included lots of sun, exploring of the island via Jeep tour, endless beverages, late night live entertainment on the pier and so much more. Our team returned to Morgantown recharged and excited for another successful year.

Thank you to all our clients, customers and reliable referral sources for trusting us with your projects. Check out some of our favorite moments below.

View our February Newsletter: Calling All Investors | Multifamily, Office & Land

View our Jan. Newsletter: Reflecting and Projecting 2022 – 2023

Congratulations! You just rode one of the wildest rollercoasters the modern economy has ever experienced. Roughly one year ago, experts predicted interest rates would begin ticking up twenty-five to fifty basis points, with a target of 4.5 to 5% interest rates. The goal was, and still is, to fight record high inflation (9.1% in June 2022; a 40-year high). Many projections were far off, including ours. In today’s market, a 4.5 to 5.0% interest rate on a deal is unheard of and would make investors drool. As we enter a new year, we are looking at the prime rate hovering in the mid sevens; that’s 7.5%! This marks a 400-basis point increase in the past nine months.[i] Last year experienced the most aggressive economic tightening campaign in over three decades. So, how does that affect commercial real estate?

Rising interest rates put downward pressure on valuations. Financial institutions, including regional and national banks, typically want to achieve a 1.20 to 1.25 debt-service coverage ratio (DSCR), meaning 20%-25% of a project’s cash flow is available to pay current debt obligations. When the cost of borrowing funds increases, meeting required DSCR ratios is more difficult, and a buyer cannot afford to pay as much value to a seller while still maximizing leverage (borrowing power). A buyer either has to come up with more capital to lower the loan-to-value (LTV) ratio or lower the offer price. Here is an example:

ABC Investment LLC has renovated an asset and wants to cash out to redeploy capital into the next project. You like the asset a lot. You offer full asking price – $1,250,000. A bank that requires an 80% LTV ratio (some banks will offer lower, say – 70-75% LTV) will result in you needing to borrow $1,000,000. Nine months ago (Q2 2022), you could have hypothetically achieved an interest rate of 3.65% (Black Diamond often saw rates between 3.25% to 4.00%). Amortizing $1,000,000 over 20 years at 3.65% interest results in a monthly payment of $5,876.97. Fast forward nine months (Q1 2023), and that same loan structure has changed drastically.[1]

As of December 15, 2022, the current prime rate is 7.5% in the U.S., according to The Wall Street Journal’s Money Rates table, which lists the most common prime rates charged throughout the U.S. and in other countries by averaging out the prime rate from the ten largest banks in each country. The federal funds rate is currently 4.25% to 4.50%. With that in mind, you can see how the “fed funds plus 3.00” rule of thumb plays out: 3.00% + 4.50% = 7.50%.[ii] At Black Diamond Realty, we would argue this rate is very conservative, as our experience has resulted in many regional banks willing to entertain deals at lower interest rates – with a 250 to 300 basis point spread in play.

Getting back to our example, your investment company’s new interest rate (7.25%; 275 basis point higher than federal rate) results in a monthly expense of $7,903.76. The difference between a 3.65% interest rate and a 7.25% interest rate is $2,026.79/month. The yearly difference is $24,321.48. In today’s market, let’s assume a regional multi-family asset comps out and sells at a 7% capitalization rate. Utilizing a 7% capitalization rate, the $24,321.48 yearly interest rate difference results in a downward value adjustment of $347,449.71 ($24,321.48 / 0.07). This ~$350K difference results in a seller/buyer “value gap.” Buyers are forced to react quickly because the capital markets respond within weeks, often days. Some buyers are struggling to find deals while sellers reassess their motivations to liquidate. Sellers are realizing they missed the market peak. Buyers are coming to the table with greater liquidity to meet DSCR (healthy, “bankable” deal) and bridge the seller gap.

The current market reflects the seller-buyer gap. On its own, this would be bad news for sellers everywhere. Fortunately for the market, supply and demand also comes into play. Like many things in our economy, construction materials (think Lowe’s, Menards, Home Depot) have experienced significant inflation in 2022. Construction expenses rose 13.7% since September 2021.[iii] Higher construction expenses, including excavation work, have resulted in lower nationwide new housing construction starts. Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,427,000. This is a 0.5 percent below the revised October estimate of 1,434,000 housing starts and is 16.4 percent below the November 2021 rate of 1,706,000.[iv]

The same trend is true across most sectors of commercial real estate. Higher material costs combined with higher costs of borrowing funds (interest rates) has resulted in a slowdown of new construction activity. We anticipate this trend to continue. Sticking with the multifamily sector, lower housing starts have resulted in increased rents and corresponding increased valuations. The same data shows a downward trend in construction costs during Q4, 2022 which is something to watch in 2023. So, what else can we expect in 2023?

Deals happen in all cycles of commercial real estate. Rising interest rates create downward pressure but, on the flip side, rising rents/income result in higher valuation. Do these two opposite effects counterbalance each other? The answer is specific to each commercial real estate sector (supply/demand) and the specific market. Depending upon the market, rising income is outpacing inflation which continues to push rents higher. The risk lies in the job market. Job loss and higher unemployment will eventually reduce consumer purchasing power and result in less demand for materials, goods and real estate. When unemployment rises, rent growth will be at risk for most sectors of commercial real estate. Our team is keeping a close eye on unemployment in 2023.

The ‘R’ word has been tossed around many dinner tables and watering holes across America. An economic recession occurs when GDP, which measures trade and industrial activity, declines in two successive quarters. Are we amid a recession? US Government courses reported that Quarter 3 of 2022 saw a 3.2% increase in GDP over the previous quarter.[v] This increase is welcoming news after two quarters of declining GDP. Some fear the data is artificially inflated due to the government’s easing of energy costs. The biggest challenge in reviewing federal government data is the lag. Most data lags at least three months, sometimes six, which means the Fed is making decisions based upon outdated information. What does the real estate market cycle forecast look like knowing this? Keep reading.

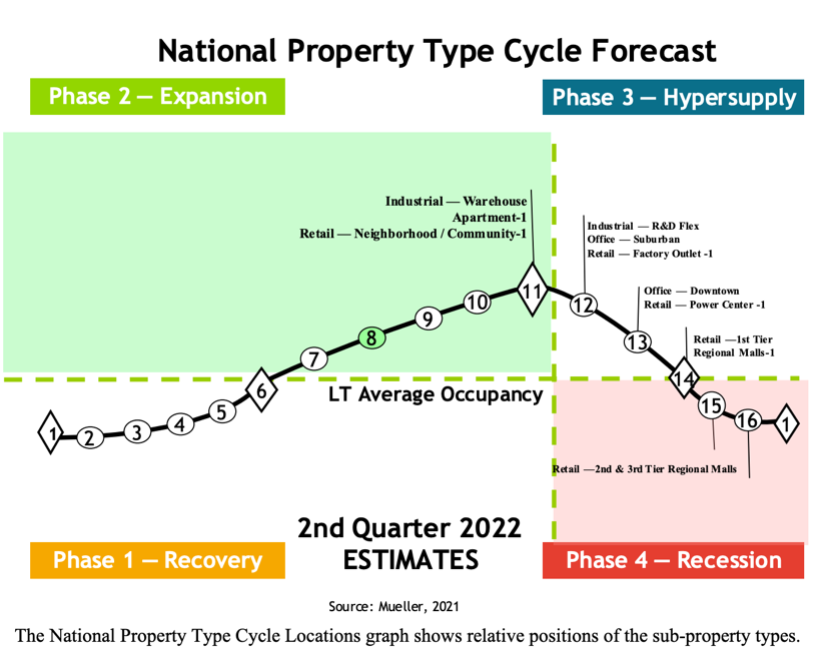

Real estate market cycles vary by sector and location, amongst other factors. Mueller’s[vi] forecasting model breaks down the real estate market cycle into four phases:

Mueller’s Real Estate Market Cycle Forecast, As of Q2-2022

There are 16 total points along the horizontal axis. Points 1-11 are in phases 1 and 2 which represent a period of growth. Points 12-16 are in phases 3 and 4 which represent a period of decline. The four market cycle quadrants have varying characteristics. Phase 1, Recovery, is characterized by declining vacancy with little to no new construction. Negative rental growth to below inflation rental growth is expected during this part of the cycle. Phase 2, Expansion, is characterized by declining vacancy with greater new construction. High rent growth is common. Phase 3, Hypersupply, is characterized by increasing construction with continued and/or increasing construction. Rent growth remains positive but begins to decline. Phase 4, Recession, experiences increasing vacancy with more completions. Below inflation and negative rent growth is experienced during this part of the cycle. The Mueller report’s primary objective is to enhance investment decision analysis – to make investors aware of national trends.[vii]

Sector breakdowns are provided in the bullet points below with quick comments about the regional market. Keep in mind what is happening in New York City, NY is not necessarily a direct correlation to what is happening in Bridgeport, WV; hence several anecdotal comments from Black Diamond Realty’s perspective which are focused on the two core areas we serve: North Central WV and WV’s Eastern Panhandle. We recommend referencing the chart as you review the points below. Mueller’s data is the black bullet points. Black Diamond’s points are white sub-bullet points. In addition to this distinction (national trend – Mueller vs. Black Diamond), bear in mind Mueller’s chart lags by two quarters. The cycle has progressed along the bell curve over the past three to six months.

Point 11: Peak of Phase 2 – Expansion Cycle

Point 12: Beginning of Phase 3 – Hypersupply

Point 13: Middle of Phase 3 – Hypersupply

Point 14: End of Phase 3 – Hypersupply

Point 15: Middle of Phase 3 – Recession

Predicting future trends is nearly impossible. Market dynamics are complex and can shift quickly. Our team of experts has made some observations and anticipations for 2023. In no way, shape or form are we suggesting these “educated guesses” to be fact. Mere predictions are not indicative of actual future results. Please consult with your professional legal and financial advisors, complete your own due diligence and draw your own conclusions pertaining to the best financial moves for you.

Black Diamond Realty Predictions:

Real estate is considered by many as a great hedge against high inflation and a strong diversification play. Income producing assets are still warm, not hot, as an investment diversification play. Activity has cooled due to higher interest rates putting downward pressure on valuations. Ranking the sectors is difficult because there are so many factors (location, age, tenant, traffic patterns, surrounding amenities, etc.) but anticipated trends can be projected. In addition, there are several macroeconomic and microeconomic items we anticipate playing out in 2023.

We recommend each party consults with its professional accountant, tax, and legal advisors to better understand the effects of market conditions and real estate transactions. Primary keys to successful investments are knowing the market, the numbers and market trends. Our professional team at Black Diamond Realty is an industry leader. Our company mission is to add value to the communities we serve. We look forward to consulting with you in 2023. Make it a successful investment year.

[1] It should be noted that interest rates can change drastically depending upon many factors, including the deal’s strength, the borrower’s financial strength (including investment and business experience), debt-to-liquidity ratios, and LTV.

SOURCES

[i] https://www.jpmorganchase.com/about/our-business/historical-prime-rate

[ii] https://www.forbes.com/advisor/investing/prime-rate/

[iii]https://www.bls.gov/opub/ted/2022/producer-prices-for-final-demand-rose-7-4-percent-over-the-year-ended-november-2022.htm

[iv] https://www.census.gov/construction/nrc/pdf/newresconst.pdf

[v] https://www.bea.gov/data/gdp/gross-domestic-product#:~:text=Gross%20Domestic%20Product%20(Third%20Estimate,(Revised)%2C%20Third%20Quarter%202022&text=Real%20gross%20domestic%20product%20(GDP,percent%20in%20the%20second%20quarter

[vi]https://www.ccim.com/uploadedfiles/content/members/cycle%20forecast%202q22.pdf

[vii]https://www.ccim.com/uploadedfiles/content/members/cycle%20forecast%202q22.pdf

[viii]https://www.cnn.com/2022/12/21/economy/consumer-confidence-index-december/index.html#:~:text=Consumer%20confidence%2C%20as%20measured%20by,inflation%20seen%20in%20four%20decades

Article by:

David Lorenze, Principal

5000 NASA Blvd, Fairmont, WV

Located within the I-79 Technology Park, 5000 NASA Blvd is a 114,055 (+/-) square foot building with multiple office suites available ranging in size from 1,622 (+/-) to 14,740 (+/-) square feet. This building is separated and identified as North Tower and South Tower. There are two elevators within each tower. The I-79 Technology Park houses multiple office buildings and is HUB Zone Certified. The property offers signage availability, and ample courtesy parking for visitors and employees.

The High Technology Park is located within the heart of the I-79 High Technology Corridor just south of Fairmont, West Virginia. The location of the I-79 Technology Park places it within one day’s drive of 60% of the U.S. population and some of the Nation’s largest cities including New York, Boston, Washington, Chicago, Atlanta, Charlotte, Philadelphia, Baltimore, Pittsburgh and Indianapolis. Access to I-79, Exit 132 can be achieved by traveling 0.8 mile southeast. The building and park are highly visible from traffic traveling in both directions along I-79.

Asset Highlights

View our detailed marketing flyer to see available suites, interior photos, floor plans and more.

________________________

1000 Technology Drive, Fairmont, WV

Located within the I-79 High Technology Park, 1000 Technology Drive (Innovation Center) is a 102,723 (+/-) square foot building with multiple office suites available ranging in size from 779 (+/-) to 6,337 (+/-) square feet. The I-79 Technology Park houses multiple office buildings and is HUB Zone Certified. The property offers high security, high end finishes, reception desk attended during office hours, free parking, conference/training room with WIFI, projector, fitness center, group fitness classes, large outdoor courtyard.

The High Technology Park is located within the heart of the I-79 High Technology Corridor just south of Fairmont, West Virginia. The location of the I-79 Technology Park places it within one day’s drive of 60% of the U.S. population and some of the Nation’s largest cities including New York, Boston, Washington, Chicago, Atlanta, Charlotte, Philadelphia, Baltimore, Pittsburgh and Indianapolis. Access to I-79, Exit 132 can be achieved by traveling 0.5 mile southeast. The building and park are highly visible from traffic traveling in both directions along I-79.

Asset Highlights

View our detailed marketing flyer to see available suites, interior photos, floor plans and more.

___

Additional Articles;

View our November Newsletter: Positive Economic Growth for the Future of the Mountain State

View our October Newsletter: 2nd Office in the Eastern Panhandle

Black Diamond Realty is proud to announce that we have officially closed on an office building along N Queen St in Martinsburg WV. Our talented Graphic Designer/Office Manager, Andrea Icenhower is permanently servicing this office along with David Lorenze and Kim Licciardi who travel from our headquarters in Morgantown WV. We are excited about the expansion of our business and will continue to uphold our commitment of ensuring the success of our clients and community. Stay tuned for more updates on the renovations of our office space and official address.

In the meantime, our Black Diamond Realty team is available and ready to help serve you. Please call Black Diamond Realty’s Martinsburg (304.901.7788) office to speak to Andrea and set up a consultation to discuss your commercial real estate needs.

Our team sees a growing need in the Eastern Panhandle for a specialized commercial brokerage firm. The Eastern Panhandle community is rich in history. Serviced by I-81, WV’s Berkeley and Jefferson Counties represent an abundance of growth, serving as the main connection between the Washington, DC / northern Virginia area and the beautiful mountains of West Virginia. We are excited to expand our team and our approach to the area.

In the beginning of August, our Graphic Designed/Office Manager Andrea and her husband Michael Icenhower packed up a Uhaul and moved to the eastern panhandle where Andrea will head the new office. Andrea recently joined the Leadership Jefferson program which is sponsored by the Jefferson County Chamber of Commerce – Jefferson Co Chamber Facebook – The Primary goal of Leadership Jefferson program is to educate current and future community leaders about JeffersonCounty’s assets, opportunities, and hurdles, to strengthen the sense of community and ensure a prosperous future.

Andrea and her other classmates will continue to meet through June 2023 to learn more about the community and to meet businesses in the area! The class of 16 will continue to work together on a class service project! We can’t wait to see what they come up with!

View our September Newsletter: Sweet Summer Goodbyes

Stakeholders of North Central West Virginia Airport recently celebrated the culmination of nearly 20 years of hoping and planning.

Gov. Jim Justice — along with a host of local leaders and officials — participated in a ribbon-cutting ceremony marking the completion of site development for the West Virginia AeroTech Park.

“Without any question, always, the airports are the heart; they’re the lifeblood of the engine that makes everything go,” Justice said. “You think of what you’ve got going on here. It is off the chart; it is un-flat-believable what’s going on.”

The AeroTech Park will house the airport’s new terminal building, an expanded taxiway, an enlarged parking lot and will provide ample build-ready land for the continued growth and development of the region’s aerospace industry.

The park’s future site is now flat and level, but just a year ago, the stretch of land adjacent to W.Va. 279 was buried under approximately 3 million square feet of earth that officials called “the mountain.”

Ron Watson, former Harrison County commissioner and former president of the Benedum Airport Authority, which governs the airport, said officials had long hoped to “move the mountain” to clear space for a new terminal building.

“The mountain has always been something that we wanted to get rid of, but we never had the means, and we really didn’t have a good plan,” he said.

“Before we could do the terminal, we had to get rid of the mountain. That was a long time in the making, and I am delighted to see the progress.”

Airport Director Rick Rock, looking out over the crowd assembled for the ribbon cutting ceremony, thanked the public for always supporting the airport.

“One of the finest lessons I learned when I started this job was to get the community to take ownership of it,” he said. “Right here is an example of a community taking ownership of it. I appreciate it — without you none of this is possible.”

The site development project, handled by Wolfe’s Excavating, was seeded by a state-backed investment announced by Justice in August 2019 — a $10 million grant from the West Virginia Infrastructure and Jobs Development Council and a $10 million loan from the state Economic Development Authority.

On July 8, the Federal Aviation Administration announced the airport would receive a $15 million grant, the final element needed to greenlight the terminal’s construction.

Bridgeport Mayor Andy Lang, who sits on the Airport’s Special Projects Committee, said numerous individuals and agencies deserve credit for helping make the project a reality.

“It was a matter of just getting everybody to the table one-by-one — whether that was the (Federal Aviation Administration), the (West Virginia Department of Environmental Protection), the state, the governor’s office, the Development office, just on and on — to realize what this project could do for North Central West Virginia,” he said.

Construction of the terminal building is expected to begin next year, Lang said.

“We should be started on the terminal, digging footers, in the spring,” he said.

The expansion project is estimated to lead to direct contributions of more than $587 million to the state’s economy each year, according to economists at West Virginia University.

The total economic impact of construction expenditures for the airport’s terminal expansion project is estimated to be $88 million, of which more than $55 million will be spent directly, and another $33 will be generated in secondary industries, according to analysis from the WVU Bureau of Business and Economic Research.

The terminal expansion project is estimated to employ about 356 construction workers directly, and another 199 in supplier industries, for a total employment impact of 555 jobs.

Growth at the airport is estimated to add an additional $16.7 million in expenditures in the local economy over 10 years. Counting secondary impacts, it’s estimated this spending will result in more than $28.5 million in total economic impact over the same 10-year period.

Expansion on the airport’s campus is expected to allow for the addition of seven to 11 small-to-medium-sized businesses that will either expand or locate in the area, for a total of more than 1,300 new jobs.

The airport is one of the main reasons North Central West Virginia is one of the state’s two primary centers for economic activity, according to WVU’s John Deskins.

“This airport and this aerospace sector in Harrison County is one of the key, foundational pieces that is enabling North Central to be a standout region,” he said. “I think that’s pretty important.”

Original Article by Charles Young on August 22, 2022 on wvnews.com

New York(CNN Business)US natural gas prices have skyrocketed to levels unseen since 2008, a spike that threatens to offset the benefits of falling prices at the gas pump.

Natural gas futures surged 7% on Tuesday to close at $9.33 per million British thermal unit (BTU), the highest closing price since August 1, 2008.

Although natural gas futures cooled off a touch on Wednesday, they remain up about 70% just since the end of June. And natural gas is up a staggering 525% since closing at $1.48 in June 2020 when Covid-19 had shut much of the US economy down.

The summer spike is being driven in part by high demand as scorching temperatures through much of the country force Americans to crank up the air conditioning. That in turn has chipped away at relatively low inventory levels.

“We’ve had this perma-heat wave cooking the United States,” said Robert Yawger, vice president of energy futures at Mizuho Securities.

As temperatures drop this fall and winter, the natural gas spike signals sticker shock for families. Not only is natural gas a leading fuel source for the electric grid, it’s the most popular way to heat homes in America.

“Depending on the weather, it could be a challenging winter,” said Rob Thummel, senior portfolio manager at Tortoise Capital Advisors. “But not as challenging as in Europe. They are at risk of running out of natural gas. We aren’t.”

Europe’s natural gas crisis is being driven by its reliance on energy from Russia, which has slashed natural gas flows to Europe in response to Western sanctions.

The European Union has been forced to lay plans to ration natural gas, a drastic step that will hurt families and businesses. Natural gas prices have skyrocketed so high in Europe that it threatens to send the continent’s economy into recession.

For context, Europe’s natural gas prices are trading at levels equivalent to about $70 per million BTUs, according to Andy Lipow, president of Lipow Oil Associates. That is roughly seven times higher than prices in the United States.

But that is little consolation to Americans grappling with high prices at the grocery store, clothing stores and at restaurants.

Even as natural gas prices surge, oil prices have tumbled, helping to drive gasoline prices sharply lower. The national average for regular gasoline has dropped 64 days in a row, according to AAA.

Analysts say Europe’s natural gas crisis is contributing to the higher natural gas prices in America, although it’s not the main driver.

“Higher global prices are trickling down to the US. Natural gas has become a global commodity with the emergency of LNG,” said Thummel.

The United States has stepped up its exports of liquefied natural gas (LNG) to Europe in an effort to mitigate the impact of the loss of Russian gas.

“Every spare molecule we can find, we are shipping to the eurozone,” said Yawger.

But the bigger issue for US natural gas is the fact that inventory levels are below historical averages, leaving the market with less of a buffer and driving up prices.

“We entered this year at beaten-down levels and we never caught up,” Yawger said.

Supply has failed to keep up with strong demand for gas. Thummel pointed to how US oil and gas producers are under pressure from Wall Street to spend less on expensive drilling projects and more on dividends and buybacks to shareholders.

“We need more US natural gas production. The production levels are too low,” Thummel said.

The good news is that higher prices should, eventually, incentivize more production. And investors are not betting today’s high prices will continue. The futures market indicates natural gas prices should be almost 50% lower at this point next year.

Then again, very few people thought a year ago natural gas prices would be at 2008 levels. And yet here we are.

Original Article by Matt Egan, CNN Business on August 17, 2022.

View our August Newsletter: Inflation Fears…Nobody is Immune

For many Americans, these feelings and beliefs have embedded themselves into our cultural fabric. Reminders of uncertain, and for many, challenging times are plentiful. Gas pump prices have soared over the past 12 months. A gallon of milk is 11.2% higher in the same time period. Your favorite morning coffee tastes a little less fulfilling with the higher price tag. Our society has shifted from one cultural extreme to another – enduring a long stay-at-home mandate that stressed the core of human interaction needs to an economy flooded with out-of-control inflation. Why is this happening? What comes next? Our team of experts has thoughts and ideas. Before reading further, please know these thoughts, beliefs and predictions may make you uncomfortable. They are observations and beliefs; not a crystal ball reading. Time will tell how things play out.

Rich or poor, black or white, urban or rural – nobody is immune from its unwanted presence and the corresponding challenges it creates. Every month, the federal government reports inflation data in several different ways. As commercial real estate specialists, our Black Diamond Realty team pays close attention to the CPI, which stands for Consumer Price Index. The CPI recently hit multi-decade highs at 9.1% or (https://www.npr.org/2022/07/13/1111070073/no-retreat-in-the-summer-heat-prices-likely-topped-40-year-high-last-month). For perspective, dating back to 1913 (but first published in 1921), the CPI’s historical average is ~3.3%. For even greater perspective, the decade from 2011-2020 experienced total inflation of 17.3% which is an average of 1.73% per year. Reflecting upon recency which tends to dominate human thinking, in the past 12 months, we have experienced the equivalent of five plus years of inflation packed into one year (1.73% x 5 years = 8.65%).

Most of our nation’s current inflation can be pinned to two primary factors. The first factor is stimulus money. The federal government injected over $5 trillion into America’s money supply over a 24 month period via Covid relief funds. This amount represents roughly 27% of the current money supply in circulation. More money in citizen pockets led to increased spending. The higher velocity of spending creates inflation. To combat this velocity, the federal government utilizes one of its key control levers, interest rate fluctuation, to control spending habits. The goal of increasing interest rates is to decrease spending in an effort to slow down the economy. The Feds recent rate increases illustrate the government’s concern that inflation is running too hot. The impending challenge is the Fed’s interest rate hikes are only geared toward addressing the demand (spending habits) side of the equation. It does not address the supply side. The Fed faces an unprecedented task of reining in high inflation with 40% additional money in play.

Simply put, our dollars today are significantly less valuable (lower purchasing power) than they were 12 months ago. Stimulus money aims to help those most in need; those individuals most vulnerable and lowest on the earning potential food chain. The irony is disheartening… Our government over-injected for short-term benefit, thereby creating a long-term inflation challenge. The band aid (government stimulus checks) has been pulled while the wound has intensified. Printing money and more government spending is it the answer to stop the bleeding.

Under President Biden, an extreme focus on sustainable, clean energy has resulted in an under supply of oil and gas. In the long run, most agree this will be better for our planet and the sustainability of our nation. Others will point out this goal is a multi-decade process to reach a level of production and reliability to avoid power shortages and blackouts. In the short term, President Biden’s regime eliminated the ability to drill on most federal lands. The recent stay-at-home mandate also resulted in lower power consumption which led drilling companies to halt operations. Sanctions placed on Russia are also in play. The following article goes into great detail about how high energy costs greatly affect inflation: https://www.nytimes.com/interactive/2022/06/14/business/gas-prices.html

It is impossible for any individual to look into their crystal ball to decipher the outlook 1, 3 or 5 years out. Nonetheless, our team has put together a list of educated guesses.

Please note that statements based on forward-looking estimates may not materialize; there are no guarantees of future economic performance.

Warren Buffet has profited billions with a simple, straightforward investment strategy. Fear creates irrational decisions which lead to opportunities. “Buy when there is fear in the market.” The world’s current fear, uncertainty and challenges will result in tremendous buying opportunities.

The fundamentals of successful commercial real estate investing is changing. Our team of experts recommends keeping the following tips in mind.

We live in a world of challenges. Fear and anxiety are at all time highs for some. We survived the 1973-81 recession and will certainly overcome the present day’s hurdles. The United States has proven, many times over, to be a dynamic and resilient culture with the ability to overcome adversity. Proceed with caution, be prepared to pounce and consistently monitor opportunities. Buckle up. Remember rainbows only show after periods of rain. Challenging times present wealth building opportunities.

Our Black Diamond Realty team can help guide you. Please call Black Diamond Realty’s Morgantown (304.413.4350) or Martinsburg (304.901.7788) office to set up a consultation with one of our experts.

Article by:

David Lorenze, Principal

West Virginia is now on its way toward launching the state’s second small satellite. A team from West Virginia University and the NASA West Virginia Space Grant Consortium is poised to turn that achievement into a massive boost for the aerospace industry statewide by taking the first steps toward opening the West Virginia Small Satellite Center of Excellence.

The SmallSat Center will work with businesses and other organizations to develop West Virginia’s second small satellite and to help those partners offer services and products to clients who want to fly experiments out to low orbit. As Melanie Page, director of the Space Grant Consortium, put it, “It’s like a ‘Field of Dreams’ for small satellites.”

With the announcement of $911,708 in U.S. Economic Development Administration funding, that mission is a go.

West Virginia’s first small satellite, STF-1, launched from New Zealand in 2018 and vastly exceeded the usual three-month lifespan for a SmallSat – it’s still up there, transmitting from outer space, more than 1,300 days later. When it came time to capitalize on STF-1’s success, Candy Cordwell, assistant director of the Space Grant Consortium, and Majid Jaridi, former director, envisioned the next SmallSat kickstarting and sustaining an entire industry for aerospace research, products and services in West Virginia.

The EDA’s Assistance to Coal Communities grant goes to projects that advance economic diversification, aerospace manufacturing and STEM training opportunities in areas severely affected by the declining use of coal. In the case of WVU’s initiative, Page said the money will not only support the Innovative Orbital Test Array mission, or IOTA, in which a second SmallSat will be produced and launched as STF-1’s proof of concept, but it will also enable the opening of the SmallSat Center of Excellence.

The Center will be a hub for small satellite research, development, testing, production and commercialization, and “truly an innovation incubator that meets the needs of an industry that meets the needs of customers,” according to David Martinelli, professor of civil and environmental engineering at the Benjamin M. Statler College of Engineering and Mineral Resources, who has joined forces with Cordwell and Page to launch the SmallSat Center.

“We’re going to be building satellites in West Virginia,” he said. “As soon as STF-1 was up there for 300 days, people started saying seriously that this is something we should be very proud of and try to capitalize on, and Candy Cordwell and Majid Jaridi came up with the concept of positioning space as an industry for West Virginia. STF-1 was built with West Virginia talent and West Virginia capability. I think that speaks to the likelihood of our success for step two.”

Cordwell said she was thrilled about the project’s potential to kickstart an industry that will have Mountain State residents designing and building satellites destined for the stars.

“This could enable West Virginia to participate in the rapidly growing commercial sector associated with the launch and operation of small satellites,” she said. “The very unique and exciting aspect of this project is that it brings academic, industrial and government partners together to initiate and foster a research center that will bring jobs and economic activities to North Central West Virginia.”

Demand for small satellites is very much on the rise, Page added, with the global market expected to hit more than $3 billion a year and with a robust client base that include governments, companies and research institutions. The SmallSat Center will support West Virginia businesses in serving customers that could range from a telecommunications company to a national cybersecurity program or a research institute monitoring climate change. It will be those clients’ needs that help drive the design of the second-generation IOTA satellite.

Like STF-1, the second SmallSat will be fitted with a flight computer, radio, solar panels and cells, a camera and other instruments for data detection and collection, as well as slots for the satellite’s payload — computer cards that carry the clients’ instructions to the satellite, whether they’re looking to use it to monitor space weather or enable in-car navigation systems.

The IOTA SmallSat may be a three-unit cube satellite, like STF-1, with a form based around three 10-centimeter cubes, or it could be scaled up to a six-unit CubeSat. Or it might take a different form altogether, according to the feedback the SmallSat Center will hear from potential clients and partners.

“Let’s say that a client came to the Center and said, ‘We’re really interested in a satellite that serves a certain need,’” Martinelli said. “What we may do first and foremost is put them in touch with one of our private partners in the state and say, ‘OK, here’s the company that’s ultimately going to build this satellite for you.’ Then we would work with that company to find out what needs to be done, to help them deliver whatever that commercial need is. Our role is to use our talents and facilities and opportunities to fill the innovation gaps to help a West Virginia company serve a client for a small satellite.”

Martinelli relishes the fact that this project is equal parts science and industry, theory and practice.

“What makes this special is that, although West Virginia currently has significant space-related activities, I believe this is the first one that’s truly commercial. West Virginia has research contracts with NASA and related agencies, but the idea of space commercialization and industry in West Virginia is new,” he said.

“We’ve demonstrated we can produce space products in West Virginia. We now have to demonstrate that we can produce space products that have market value, so I want to make sure that from day one the innovation is very intentional in terms of bringing value to as many different industries as possible.”

Cordwell said the SmallSat Center will create 15 new jobs immediately: five at WVU and 10 through the consultant company that will initially be contracted to offer small satellite simulation, design, manufacturing, deployment and management services to the team. Within three to five years, as the center becomes financially self-sustaining, she predicted that the high-wage staff positions will increase to more than 30 jobs in administration, business development, education and advanced aerospace manufacturing.

Martinelli said he believes it won’t be long before West Virginia has a significant need for “computer scientists and engineers of all types – electrical and computer engineers, chemical and aerospace engineers, even structural engineers – as well as analysts, people who know how to work with data. That’s going to be a big part of it because ultimately the value of the satellite is usually data driven. Data is the ultimate product and many emergent companies here will need somebody who knows how to work with data, statisticians and analysts and modelers and mathematicians.”

Page pointed out that, considering West Virginia lost 1,800 technology and science jobs between February and May 2020, making sure those aerospace positions are filled by skilled, trained West Virginians is part of the vision, too.

“If you talk to anyone that’s in engineering or a STEM field, they say two things matter in terms of someone’s decision to follow that career path,” Martinelli said. “No. 1 is that you get to them early. No. 2 is that there’s somebody, maybe a family member or maybe someone else in their life, who works in STEM.”

Martinelli acknowledged that too many youth in West Virginia lack one or both of those opportunities but said he’s passionate about engineering education and growth in STEM.

“We’re going to use the SmallSat Center as an opportunity to hit that aggressively. I certainly will look at all possibilities to showcase what we’re doing to K-12 students,” he said.

“This is the advantage of working with the University, the fact that it gives us not just our research capabilities, but the educational mission as well. We have our clean room and labs where the satellite will be assembled and components tested and so forth. I want to see a parade of students in there on elementary school field trips. I want to see young students going through the facility where they talk to engineers and foster interest in STEM careers.”

Original Article by WVU Today on wvutoday.wvu.edu, July 20, 2022.

View our July Newsletter: BDR Kicks Off Summer With A Splash!

View our June Newsletter: Starting A New Business? Don’t Do It Alone!

View our May Newsletter: May Newsletter: The Power of a 1031 Exchange

Nine out of 10 US millionaires have found tremendous financial success in real estate investment. Read the seven reasons why 90% of millionaires choose to invest in real estate and why you should too in this article.

The federal government’s rules and regulations offer favorable incentives including annual depreciation and interest expense deductions. These tax deductions encourage investors to deploy money into real estate. The most favorable, generational wealth building tool can be found in Section 1031 of the IRS code. According to IRS.gov,

Whenever you sell a business or investment property and you have a gain, you generally have to pay tax on the gain at the time of sale. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange.

A 1031 exchange allows a real estate seller to defer paying taxes so he or she can leverage capital gains into a larger asset with presumably greater cash flow. The IRS essentially allows an investor to ‘kick the can down the road’ and reinvest the government’s money via a 0% interest loan. The taxes do not disappear, but an investor has the opportunity to leverage the government’s money into larger assets. The 1031 program rewards investors while encouraging further investment in real estate.

This is one of the greatest wealth building tools that exists, because there is no limit on the number of times an investor can utilize a 1031 tax exchange. The federal government is also flexible on the definition of a like kind property. For example, you can sell an apartment building and purchase an office building, land, industrial building, or an asset in a different sector of real estate. To qualify for a 1031 like-kind tax exchange, there are important rules and regulations that must be met. Identification timeframe and the process are two key items to understand.

The government offers two primary identification methods for a 1031 exchange. Both methods require the seller to utilize an intermediary to quarterback the process. Some intermediaries specialize in only 1031 transactions. Other investors choose to utilize their preferred real estate attorney, whose firm is capable of handling a 1031 transaction. To execute a 1031, it is imperative the exchanger (seller of relinquished property) hire an intermediary who handles the 1031 transaction, before the relinquished property closes. A 1031 is considered null and void if the seller (of the relinquished property) takes position of the funds from the relinquished asset sale. More information about the top ten identification rules for a 1031 exchange can be found here.

The traditional 1031 method allows for a 45-day requirement to identify and designate property to purchase, once the relinquished property has sold. There are two “identifying” rules that govern how many properties can be identified. The first rule allows an exchanger to identify up to three properties to purchase. The second method allows an exchanger to identify as many properties as desired, up to 200 percent of the value of the relinquished asset. The second timeframe rule pertains to total days to purchase the replacement asset(s). From the sale of the relinquished asset (property sold), you have 180 days to finalize a transaction to purchase a replacement property or properties.