Reflecting and Projecting 2022 – 2023

Congratulations! You just rode one of the wildest rollercoasters the modern economy has ever experienced. Roughly one year ago, experts predicted interest rates would begin ticking up twenty-five to fifty basis points, with a target of 4.5 to 5% interest rates. The goal was, and still is, to fight record high inflation (9.1% in June 2022; a 40-year high). Many projections were far off, including ours. In today’s market, a 4.5 to 5.0% interest rate on a deal is unheard of and would make investors drool. As we enter a new year, we are looking at the prime rate hovering in the mid sevens; that’s 7.5%! This marks a 400-basis point increase in the past nine months.[i] Last year experienced the most aggressive economic tightening campaign in over three decades. So, how does that affect commercial real estate?

Rising interest rates put downward pressure on valuations. Financial institutions, including regional and national banks, typically want to achieve a 1.20 to 1.25 debt-service coverage ratio (DSCR), meaning 20%-25% of a project’s cash flow is available to pay current debt obligations. When the cost of borrowing funds increases, meeting required DSCR ratios is more difficult, and a buyer cannot afford to pay as much value to a seller while still maximizing leverage (borrowing power). A buyer either has to come up with more capital to lower the loan-to-value (LTV) ratio or lower the offer price. Here is an example:

ABC Investment LLC has renovated an asset and wants to cash out to redeploy capital into the next project. You like the asset a lot. You offer full asking price – $1,250,000. A bank that requires an 80% LTV ratio (some banks will offer lower, say – 70-75% LTV) will result in you needing to borrow $1,000,000. Nine months ago (Q2 2022), you could have hypothetically achieved an interest rate of 3.65% (Black Diamond often saw rates between 3.25% to 4.00%). Amortizing $1,000,000 over 20 years at 3.65% interest results in a monthly payment of $5,876.97. Fast forward nine months (Q1 2023), and that same loan structure has changed drastically.[1]

As of December 15, 2022, the current prime rate is 7.5% in the U.S., according to The Wall Street Journal’s Money Rates table, which lists the most common prime rates charged throughout the U.S. and in other countries by averaging out the prime rate from the ten largest banks in each country. The federal funds rate is currently 4.25% to 4.50%. With that in mind, you can see how the “fed funds plus 3.00” rule of thumb plays out: 3.00% + 4.50% = 7.50%.[ii] At Black Diamond Realty, we would argue this rate is very conservative, as our experience has resulted in many regional banks willing to entertain deals at lower interest rates – with a 250 to 300 basis point spread in play.

Getting back to our example, your investment company’s new interest rate (7.25%; 275 basis point higher than federal rate) results in a monthly expense of $7,903.76. The difference between a 3.65% interest rate and a 7.25% interest rate is $2,026.79/month. The yearly difference is $24,321.48. In today’s market, let’s assume a regional multi-family asset comps out and sells at a 7% capitalization rate. Utilizing a 7% capitalization rate, the $24,321.48 yearly interest rate difference results in a downward value adjustment of $347,449.71 ($24,321.48 / 0.07). This ~$350K difference results in a seller/buyer “value gap.” Buyers are forced to react quickly because the capital markets respond within weeks, often days. Some buyers are struggling to find deals while sellers reassess their motivations to liquidate. Sellers are realizing they missed the market peak. Buyers are coming to the table with greater liquidity to meet DSCR (healthy, “bankable” deal) and bridge the seller gap.

The current market reflects the seller-buyer gap. On its own, this would be bad news for sellers everywhere. Fortunately for the market, supply and demand also comes into play. Like many things in our economy, construction materials (think Lowe’s, Menards, Home Depot) have experienced significant inflation in 2022. Construction expenses rose 13.7% since September 2021.[iii] Higher construction expenses, including excavation work, have resulted in lower nationwide new housing construction starts. Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,427,000. This is a 0.5 percent below the revised October estimate of 1,434,000 housing starts and is 16.4 percent below the November 2021 rate of 1,706,000.[iv]

The same trend is true across most sectors of commercial real estate. Higher material costs combined with higher costs of borrowing funds (interest rates) has resulted in a slowdown of new construction activity. We anticipate this trend to continue. Sticking with the multifamily sector, lower housing starts have resulted in increased rents and corresponding increased valuations. The same data shows a downward trend in construction costs during Q4, 2022 which is something to watch in 2023. So, what else can we expect in 2023?

Deals happen in all cycles of commercial real estate. Rising interest rates create downward pressure but, on the flip side, rising rents/income result in higher valuation. Do these two opposite effects counterbalance each other? The answer is specific to each commercial real estate sector (supply/demand) and the specific market. Depending upon the market, rising income is outpacing inflation which continues to push rents higher. The risk lies in the job market. Job loss and higher unemployment will eventually reduce consumer purchasing power and result in less demand for materials, goods and real estate. When unemployment rises, rent growth will be at risk for most sectors of commercial real estate. Our team is keeping a close eye on unemployment in 2023.

The ‘R’ word has been tossed around many dinner tables and watering holes across America. An economic recession occurs when GDP, which measures trade and industrial activity, declines in two successive quarters. Are we amid a recession? US Government courses reported that Quarter 3 of 2022 saw a 3.2% increase in GDP over the previous quarter.[v] This increase is welcoming news after two quarters of declining GDP. Some fear the data is artificially inflated due to the government’s easing of energy costs. The biggest challenge in reviewing federal government data is the lag. Most data lags at least three months, sometimes six, which means the Fed is making decisions based upon outdated information. What does the real estate market cycle forecast look like knowing this? Keep reading.

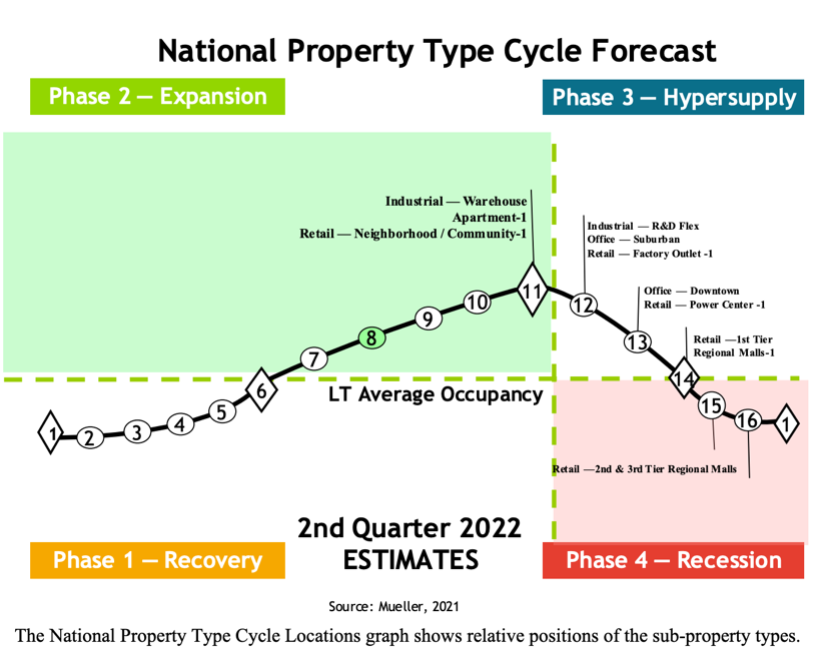

Real estate market cycles vary by sector and location, amongst other factors. Mueller’s[vi] forecasting model breaks down the real estate market cycle into four phases:

- Recovery

- Expansion

- Hypersupply

- Recession

Mueller’s Real Estate Market Cycle Forecast, As of Q2-2022

There are 16 total points along the horizontal axis. Points 1-11 are in phases 1 and 2 which represent a period of growth. Points 12-16 are in phases 3 and 4 which represent a period of decline. The four market cycle quadrants have varying characteristics. Phase 1, Recovery, is characterized by declining vacancy with little to no new construction. Negative rental growth to below inflation rental growth is expected during this part of the cycle. Phase 2, Expansion, is characterized by declining vacancy with greater new construction. High rent growth is common. Phase 3, Hypersupply, is characterized by increasing construction with continued and/or increasing construction. Rent growth remains positive but begins to decline. Phase 4, Recession, experiences increasing vacancy with more completions. Below inflation and negative rent growth is experienced during this part of the cycle. The Mueller report’s primary objective is to enhance investment decision analysis – to make investors aware of national trends.[vii]

Sector breakdowns are provided in the bullet points below with quick comments about the regional market. Keep in mind what is happening in New York City, NY is not necessarily a direct correlation to what is happening in Bridgeport, WV; hence several anecdotal comments from Black Diamond Realty’s perspective which are focused on the two core areas we serve: North Central WV and WV’s Eastern Panhandle. We recommend referencing the chart as you review the points below. Mueller’s data is the black bullet points. Black Diamond’s points are white sub-bullet points. In addition to this distinction (national trend – Mueller vs. Black Diamond), bear in mind Mueller’s chart lags by two quarters. The cycle has progressed along the bell curve over the past three to six months.

Point 11: Peak of Phase 2 – Expansion Cycle

- Industrial – Warehouse

- Remains strong throughout north central WV and WV’s Eastern Panhandle. For north central WV, keep an eye on oil and gas volatility/strength in 2023. For WV’s Eastern Panhandle, we are watching consumer confidence and retail strength.

- Apartment

- Remains strong in both markets due, in part, to the ability to push rental rates to counteract rising interest rates.

- Retail – Neighborhood/Community

- Still demand albeit at a slowing pace in both markets. Headwinds are forming which we believe will negatively affect all subsectors of retail.

Point 12: Beginning of Phase 3 – Hypersupply

- Industrial – R&D Flex

- Flex space has remained strong in both markets. North central WV has an undersupply of quality, newer flex space with docking capability. The Eastern Panhandle has consistently filled any new supply but it appears some headwinds could be forming (Hypersupply phase) where new product is taking longer to secure tenancy.

- Office – Suburban

- Demand still exists albeit at a slower clip compared to pre-Covid.

- Retail – Factory Outlet

Point 13: Middle of Phase 3 – Hypersupply

- Office – Downtown

- Major metro markets have struggled post-Covid. In smaller/tertiary markets, he jury is still out on whether long-term leases will restructure plans as

- Retail – Power Center

Point 14: End of Phase 3 – Hypersupply

- Retail – 1st Tier

- Regional Malls

Point 15: Middle of Phase 3 – Recession

- 2nd & 3rd Tier Regional Malls [vii]

Predicting future trends is nearly impossible. Market dynamics are complex and can shift quickly. Our team of experts has made some observations and anticipations for 2023. In no way, shape or form are we suggesting these “educated guesses” to be fact. Mere predictions are not indicative of actual future results. Please consult with your professional legal and financial advisors, complete your own due diligence and draw your own conclusions pertaining to the best financial moves for you.

Black Diamond Realty Predictions:

Real estate is considered by many as a great hedge against high inflation and a strong diversification play. Income producing assets are still warm, not hot, as an investment diversification play. Activity has cooled due to higher interest rates putting downward pressure on valuations. Ranking the sectors is difficult because there are so many factors (location, age, tenant, traffic patterns, surrounding amenities, etc.) but anticipated trends can be projected. In addition, there are several macroeconomic and microeconomic items we anticipate playing out in 2023.

- Multifamily and industrial are anticipated to remain strong in the markets we serve. However, look for headwinds beginning to form within 12 to 24 months. Office is the weakest sector as evidenced by higher-than-average historical vacancy rates caused by lower demand created, in part, by work-from-home trends.

- Tertiary markets with a core employment base of eds, meds and government jobs (considered recession resistant) will become more attractive to outside investors who are seeking a “safe place” to park capital. West Virginia has significant positive momentum as evidenced by the numerous basic employment announcements throughout 2022. Tertiary markets, similar to several growing areas in West Virginia (North Central, Eastern Panhandle), offer higher cap rates which are attractive to investors. Review Black Diamond Realty’s October newsletter article which compiles numerous statewide job announcements. Click Here.

- One to two additional rate hikes in the first half of 2023. We anticipate a reversal, declining rates, starting as early as Q3 or Q4, 2023.

- Can the government continue to service its debt at high interest rates? An economist who follows monetary policy, politics and global business much closer than our team will need to answer that question. What we know about monetary policy and our government’s current debt obligations is concerning, at best – downright frightening to others.

- Black Diamond Realty anticipates seeing debt options with lower LTV ratios in 2023. Banks will adjust from offering 75-85% LTV to a range of 70-80% LTV.

- Construction starts will continue to slow in most sectors. Multifamily and industrial may continue to expand in 2023 but high interest rates are putting downward pressure on construction starts.

- Consumer confidence will slip. Challenging retail financial reports will follow. There will be heightened volatility in the stock market.

- Our belief is that we are in the midst of a recession. It is either already here or quickly approaching. Government data lags by several months. Consumer confidence has declined during 2022.[viii]Inflation reached record highs in 2022 although it has been declining in recent months. Some believe the inflation decline is, in part, artificially enhanced by the government’s proactive action in releasing 1 million barrels per day of oil reserves. Energy prices will remain volatile especially if/when this strategy is lifted.

- Black Diamond Realty is keeping a close eye on unemployment. When unemployment rates increase, consumer purchasing power will decline which will have a trickle up effect to GDP, negatively influencing most sectors in commercial real estate (most notably, retail).

- For Black Diamond Realty, sales volume is forecasted to decrease while leasing volume will increase which should lead to leasing price increases in the high demand sectors (industrial and multifamily).

We recommend each party consults with its professional accountant, tax, and legal advisors to better understand the effects of market conditions and real estate transactions. Primary keys to successful investments are knowing the market, the numbers and market trends. Our professional team at Black Diamond Realty is an industry leader. Our company mission is to add value to the communities we serve. We look forward to consulting with you in 2023. Make it a successful investment year.

[1] It should be noted that interest rates can change drastically depending upon many factors, including the deal’s strength, the borrower’s financial strength (including investment and business experience), debt-to-liquidity ratios, and LTV.

SOURCES

[i] https://www.jpmorganchase.com/about/our-business/historical-prime-rate

[ii] https://www.forbes.com/advisor/investing/prime-rate/

[iii]https://www.bls.gov/opub/ted/2022/producer-prices-for-final-demand-rose-7-4-percent-over-the-year-ended-november-2022.htm

[iv] https://www.census.gov/construction/nrc/pdf/newresconst.pdf

[v] https://www.bea.gov/data/gdp/gross-domestic-product#:~:text=Gross%20Domestic%20Product%20(Third%20Estimate,(Revised)%2C%20Third%20Quarter%202022&text=Real%20gross%20domestic%20product%20(GDP,percent%20in%20the%20second%20quarter

[vi]https://www.ccim.com/uploadedfiles/content/members/cycle%20forecast%202q22.pdf

[vii]https://www.ccim.com/uploadedfiles/content/members/cycle%20forecast%202q22.pdf

[viii]https://www.cnn.com/2022/12/21/economy/consumer-confidence-index-december/index.html#:~:text=Consumer%20confidence%2C%20as%20measured%20by,inflation%20seen%20in%20four%20decades

Article by:

David Lorenze, Principal