April Newsletter: Lending a Help Hand

Comments Off on April Newsletter: Lending a Help HandView our April Newsletter: Lending a Help Hand

View our April Newsletter: Lending a Help Hand

View our March Industry Newsletter: Unlock Opportunity Industrial Properties

View our February Industry Newsletter: Fall in love with the Retail / Restaurant space of your dreams

View our February Newsletter: Top 10 Closed Transactions / Reward Trip

View our January Industry Newsletter: Now is the time to Invest

View our January Newsletter: Reflecting and Projecting

As humans, it is natural for us to take things for granted. Our children will stay young forever. A business will continue on its current growth trajectory. 2023’s rapidly changing interest rate environment served as a reminder that things can change quickly. On March 17, 2022, the federal government set out to slow down an economy that was growing at an unsustainable rate. The federal funds rate rose from 0.25% to 0.50% in March 2022 to 5.25 to 5.50% on July 26, 2023 which represents the last rate hike (https://www.forbes.com/advisor/investing/fed-funds-rate-history/). That’s 500 basis points in 16 months! Rapidly increasing the federal funds rate achieved the government’s goal of slowing inflation. The speed of change was rapid, being the fastest in multiple decades, and sent shock waves throughout the commercial real estate world. Some of Black Diamond Realty’s observations are captured in the bullet points below.

2023’s theme was rapid change. What will 2024 look and feel like? Predicting the future is impossible, but national trends and experience allow us to make educated guesses. Please bear in mind you should always complete your own due diligence before making an investment decision. Black Diamond Realty’s 2024 predictions are as follows:

We often joke Black Diamond Realty is not a group of magicians. We are skilled CRE professionals whose job is to maximize exposure, navigate complicated processes and provide sound consultative investment and decision-making guidance based upon experience. We are in the commercial real estate trenches every day. We do not sell homes.

Diversifying investments, pursuit of passive income, filling a void in your portfolio’s performance (leasing) and liquidating an asset to meet long-term goals are all reasons to contact our Black Diamond Realty team. Call our team of experts today to set up a consultation. We look forward to serving you in 2024 and beyond.

Article by:

David Lorenze, CCIM Principal, and team.

View our November Newsletter: New Team Member for Martinsburg

View our November Newsletter: Black Diamond Realty’s Customized Process

It’s highly unlikely to win a game of pool just by hitting the break. Likewise, closing a commercial real estate transaction takes planning and careful execution. At Black Diamond Realty, we understand the uniqueness in every property we market, in every deal we secure, and in each client we serve. That attention to detail is not unlike that in the game of pool, where each shot must be meticulously designed according to the terrain of the felt, the balls in play, and the pockets.

The Black Diamond marketing team works diligently from the start to create custom flyers, engaging posts on various social media platforms and other marketing efforts to advertise our clients’ assets. We provide our agents with an arsenal of materials so they can be proactive in seeking the right tenants or buyer for their location. With each marketing presentation, we craft a story that appropriately aligns with our clients’ goals and promotes the attractive elements of their assets. These exclusive, personalized marking presentations are critical as we reach those in our local market in addition to tenants and investors outside of the north central West Virginia and eastern panhandle communities, through nationally recognized CRE marketplaces like LoopNet and CREXi.

The talented individuals on our marketing team have a combined 13 years of experience in the real estate industry and 23 years of experience in advertising and design. When it comes to marketing our clients’ assets, we sink the eight ball every time.

Black Diamond Realty is celebrating its 10th anniversary – an occasion to celebrate and reflect. Ten years of successful service, dedication, and growth is a testament to our firm’s foundation, team, clients, innovation, culture, and communities. It has not been easy, yet we embrace challenges as learning opportunities, which lead to refined processes that better serve our constituents. Theodore Roosevelt said, “Nothing in the world is worth having or worth doing unless it means effort, pain, difficulty…”

The firm’s growth has been organic, strategic, and partnership based. Our team prides itself on continual learning and innovation, all while staying true to our core principles rooted in integrity. Black Diamond’s model delivers high-quality client service and authentic connections within our communities.

Reaching the 10-year milestone is thrilling. We look forward to raising the standard and elevating expectations, over the next decade. On that note, let’s highlight ten of Black Diamond’s elements for success.

Presentation

We do it the best. Our three in-house graphic designers deliver exceptional presentations for every property. We work to craft marketing materials that align with our clients’ goals and make their assets shine.

Process

We are proactive. We use market data and analysis to brainstorm appropriate buyers/tenants for a project and actively pursue them.

People

Black Diamond’s team is the difference. Each Associate and marketing professional is comprehensive, committed, customized, and connected. Teamwork is at the core of our culture and instilled within our playbook for success.

Values

Black Diamond’s mission is instilled with HIT: H stands for hard work, honesty, and humility; I stands for integrity, innovation, and intelligence; T stands for trust, teamwork, and tenacity.

Mission

Our mission is to enhance the well-being of individuals and communities through our team’s service and by empowering clients to achieve great success in both their professional and personal lives through commercial real estate opportunities.

Vision

Be the dominant commercial brokerage firm in the region, all while embracing our core competencies, focusing on our formula for success, and providing unparalleled service.

Comprehensive

The Black Diamond team delivers on every angle by taking a detailed approach to achieving our clients’ goals.

Committed

The Black Diamond team is dedicated to service that ensures the success of our clients and community.

Customized

The Black Diamond team designs personalized plans, based on client and community needs, to provide the highest level of service.

Connected

The Black Diamond team possesses a unique network of resources that continues to grow through community involvement, contribution, and transforming developments.

Thank you to our clients! We treasure our relationships and understand they are built upon trust, transparency, and dedication. Cheers to triumphs we have experienced with you and to the success we pledge to achieve in the years ahead!

Article written by: Mark J. Nesselroad, Broker

Black Diamond Realty is proud to be celebrating ten years of excellence! It’s hard to believe that a whole decade has passed since we’ve first opened our doors in October of 2013. According to trends by the U.S. Bureau of Statistics, only 30% of small businesses survive to celebrate their 10th year in business. Double digits takes a talented team focused on providing value to the people and communities it serves. We are thrilled to be part of the communities we serve and are excited to continue growing for years to come.

Check out our Newsletter by clicking the link below:

View our September Newsletter: Black Diamond Realty Will Quarterback your Deal Across the Goal Line

Black Diamond Realty Will Quarterback your Deal Across the Goal Line

Every successful football team is led by a quarterback. Quarterbacks think on their feet, capitalize on the strengths of their team, call audibles when necessary and read and anticipate the defensive strategies of the opposing side, all with one goal in mind: getting into the end zone. Commercial Real Estate (CRE) transactions, both simple and complicated, need a strong quarterback to get deals across the goal line.

Much like a defense on a football team, some ‘defenders’ are both working directly against you while others are working to protect their own interests.

Defensive Team in CRE

Safeties – Time and Regulations

Line Backers – Zoning, Inspections and Utilities

Cornerbacks – Financing and Legal Issues

Defensive Ends – NIMBYs (Not In My Back Yard) and Surveys

Defensive Line – Sellers and Buyers

A good quarterback will assist you with the challenges that arise during a touchdown drive. Reading the safeties before the play, calling an audible when the line backers are lined up staring you down, checking down to your 2nd and 3rd wide out when the corners are in position to shut you down, nimble enough to escape the defensive ends when they blow past your lineman, and most important keeping the defensive line from blowing up your play or drive with a sack or tackle for loss.

With over eight years of experience and wisdom, I have quarterbacked dozens and dozens of deals across the goal line. I have seen that you not only need a winning quarterback to consistently lead a championship team, but the team he plays for needs to have a winning culture like Black Diamond Realty. Very few deals have lined up like ‘the perfect play’ where everyone maintains their assignment, the perfect pass is thrown and caught for a 65 yard TD. Reading the challenges that lay ahead, thinking on my feet, directing receivers where to go is what separates a championship quarterback from one who is just good enough to be there.

Black Diamond Realty has the experience and expertise to help navigate your commercial real estate deal, play-by-play, first down after first down, to get across the goal line. We offer a championship caliber lineup of top-notch quarterbacks that design winning game plans and ensure successful transactions while leading with a winning attitude. As another exciting season of college football is upon us, Team BDR is suited up and ready to lead you and your team to a win on the field of commercial real estate.

Contrary to popular belief, there are quite a few differences that ultimately affect the outcome of your real estate journey. David Lorenze, Principal at Black Diamond Realty, and Melissa Hornbeck, Broker of White Diamond Realty, sit down to answer some important questions that help differentiate the two.

While anyone in the state of West Virginia who takes the real estate exam can practice both commercial and residential real estate, we believe there are a number of large differences between the two and that it takes specialized expertise to navigate the two fields

Having Black Diamond Realty to specialize in commercial real estate, and White Diamond Realty to specialize in residential real estate, means that each of our teams can focus on honing their skills to give our clients the best possible service no matter what side of the table they’re on.

View our August Newsletter: Love all, Serve all

Love all, serve all.

I started playing tennis with my parents at a very young age. It was a way my family and I spent time together as well as with other friends and neighbors in our community. In the game of tennis, both players begin with a score of ‘love.’ To start a game, one player serves the ball to the other player, then the volley back and forth begins. Negotiating a commercial real estate transaction has similarities to a tennis match. One party must ‘serve’ an offer to the other, then the volley back and forth begins. Also like in the game of tennis, a good commercial real estate professional seeks information to learn about their opponent and their strengths and weaknesses. This informs the delivery of the initial serve (or offer) and the anticipated reaction. This helps when ‘serving’ an offer on a property.

I recently played the negotiation game for a new business in Morgantown. This retailer has over 29 locations nationwide where they provide the ultimate shopping experience and a unique selection of clothing and merchandise for the entire family. They have now grown to become the hometown college store for some of the greatest fan bases in the country. I knew they would be perfect for one of our most popular shopping centers here in Morgantown. My client and I worked together to come up with the perfect initial ‘serve’ to start the negotiation game. We went back and forth with the landlord several times before we landed on terms that worked for all parties involved. My client is set to open their doors the first weekend in September so they can ‘serve’ WVU football fans for the first home game.

‘Love all, serve all’ is actually the Hard Rock Café slogan, but it has always reminded me of tennis and how all players begin their match on equal ground. To the Hard Rock Café, the slogan represents their commitment to embracing diverse communities and to promote health, wellness, and environmental sustainability throughout their regions of operation. Similarly, Black Diamond Realty works to embrace and understand our community to serve all of our clients with love.

View our July Newsletter: Life is a marathon, not a sprint.

Life is a marathon, not a sprint.

In the daily race of my life, I often think about the famous idiom; Life is a marathon, not a sprint. As an active runner, I appreciate the connection to the various cadences it describes. As a commercial real estate professional, I appreciate the reassuring motivation it brings to ‘staying the course.’ Regardless of whether you associate the adage with mental or physical navigation and speed, being reminded of the importance and payoff of patience and persistence is always reassuring.

Navigating a successful commercial real estate closing or sale often brings twists and turns, complicated scenarios, and unexpected lane changes. These hurdles and the obstacle course of the deal are an exciting challenge for me, as I maintain patience in pursuit of the goal on the horizon. As with any race that I begin training for, I study the course, understand the terrain, and build a roadmap of my training schedule, all with the end in mind. I do the same with my work in commercial real estate closings. As a committed commercial real estate professional, part of my job is to assess the course, to learn, understand, and anticipate the hurdles, and to persevere under pressure. This commitment to time, talent, and patience is what sets me and our BDR team apart from others running the race.

Recently, we successfully negotiated the sale of a property that was near and dear to my heart. This client was my first client upon joining Black Diamond Realty over three years ago. The client and I became very close, so much that my week didn’t feel complete if I hadn’t spoken to her. The property she wanted to sell was a very specialized asset and was going to take a buyer that was ‘just right.’ We actively marketed this property for nearly three years. We utilized letter campaigns, targeted marketing, postcard campaigns, cold calling, carrier pigeons (just kidding)— you name it, we did it! When we finally found the perfect buyer, the fun really began. Getting the purchase agreement signed was the first hurdle of the deal and getting to the finish line was a true test of patience and endurance.

After ten months of perseverance, the property changed hands. Time has shown me that when things pop up on appraisals or inspections, it is important to be patient, to stay the course, and to continue to push forward to find a successful resolution. When the dust finally settled and we closed on this sale, we achieved our clients’ goals AND the buyers’ goals as well. This is what we strive for with all of our transactions.

Every property is different. Every transaction is different. Every race is different. However, there is always a path that ends at the finish line and Black Diamond is the commercial real estate team that knows the way. Have our team join you on your next commercial real estate journey, your next race. No matter the distance, we know how to stay the course and get you to the finish line.

View our June Newsletter: The “HIT” Approach to Success

Building a Winning Strategy: Black Diamond Realty’s “HIT” Approach to Commercial Real Estate Success

As one of the newest Black Diamond Realty (BDR) members, I am proud to step up to the plate and be part of a team that embodies the core values of Honesty, Integrity, and Teamwork. In the game of commercial real estate, these values are the foundation of our success. And in the game of baseball, where every “HIT” counts, Black Diamond Realty delivers exceptional results for our clients. Our commitment to “HIT” positions us as the finest choice for commercial real estate services in West Virginia and Southwestern Pennsylvania. Allow me to share a few personal experiences that illustrate how the power of “HIT” has boosted us to consistently achieve success for our clients.

Stepping Up to the Plate with Honesty

In my journey as an agent at Black Diamond Realty, I quickly learned that honesty, with my team, our clients, and myself, is the first base of trust. It is stepping up to the plate and facing the pitcher with unwavering confidence. Early in my career with BDR, I recall a situation where I was representing a buyer who had recently sold his businesses and wanted to 1031 exchange into a relatively passive multitenant retail investment property occupied by a strong national tenant that seemed promising on the surface. However, after conducting thorough research and analysis, I discovered potential pitfalls that the client was unaware of, including a broad restrictive covenant in the national tenant’s lease that could have severely impacted the ability to lease other vacancies in the future. Just like a batter recognizing a curveball, I quickly adjusted my approach. I was upfront with the client and explained my findings, even though it meant advising against the investment and the potential for a substantial commission. This transparent approach solidified the trust between us and set the groundwork for our next ‘at bat’ together.

Covering the Bases with Integrity

I represented a client in the sale of his mobile home park recently. He relied on me to deliver on multiple tasks that were outside of my position as an agent but vital for the deal to progress. Just like a pitcher covers first base on an outside ground ball, I committed to upholding the integrity of my role and our team with my reach of strategic planning, transparent communication, and dedication. I maintained professional integrity and the integrity of the deal by building trust, fostering positive outcomes, and nurturing long-lasting relationships. At Black Diamond Realty, we embrace integrity as our winning strategy, ensuring that we pitch a perfect game by upholding our commitments and going the extra mile for our clients.

Hitting a Grand Slam with Teamwork

By collaborating with a diverse group of professionals, we unite unique talents and perspectives to establish a culture of success, a culture of hitting grand slams for our clients. In a recent project, our team resembled a well-coordinated infield, smoothly offloading a complex investment portfolio. We covered every angle and anticipated every opportunity. By knowing each team member’s strengths, we were able to quickly divide roles and strategically adjust our playbook for this opportunity. Through consistent communication and scheduled scoreboard reviews, our team was able to track the progression of the deal, troubleshoot challenges, and hold each other accountable. Everyone proactively took charge of their role and played their position flawlessly, from prospecting to due diligence and closing. Together, we hit a grand slam for our client, surpassing their expectations and showing the power of teamwork in achieving real estate victories.

In baseball, every hit has the potential to change the game; and although HIT carries a different meaning with Black Diamond Realty, it also reflects our team’s winning strategy. As an associate at Black Diamond Realty, I have witnessed the power of “HIT” in action. It is evident that through our commitment to these core values, we consistently deliver exceptional results for our clients. Step up to the plate with Black Diamond Realty and together as a team, we will swing for the fence.

View our May Newsletter: How Are Golfing And Commercial Real Estate Similar

Black Diamond Realty is like a seasoned golfer who consistently hits the fairway and sinks putts. And, like in the game of golf, our team’s unique approach and execution ensures successful commercial real estate transactions. This experience ‘swinging’ has delivered nearly 600 ‘holes in one’ as we approach a decade of service to the industry.

Do you think a course record could be secured using only a nine-iron and an old ball while wearing a tuxedo? Of course it couldn’t! Even if the tuxedo got a few good laughs, the golf pro probably would not invite you back to play anytime soon. Seasoned golfers typically use 14 different clubs, shoes with spikes, tees, a golf glove, high quality balls and proper attire that facilitates effective movement in given weather conditions. This level of detail and preparedness is like BDR’s approach to real estate deals. Our equipment includes seven dedicated associates, three fulltime graphic designers and a partnership with Glenmark Holding that combines decades of experience, leadership and service.

A first-time a golfer meets unexpected challenges navigating unknown courses, like a pesky oak tree with a low hanging branch on hole 11 or a water hazard at the edge of a sloping green on hole 17. An experienced golfer calls on previous games having navigated these hazards and can predict and adjust their game accordingly. The BDR professionals draw on their past experiences just as an experienced golfer does, while recognizing that every course, every project and every client is unique. Tiger Woods is one of golf’s most elite players because he practiced golf consistently from a very young age. He didn’t dedicate his mornings to tennis and afternoons to golf. He was committed and all in to his one sport. The same holds true for Black Diamond Realty. We are 100% focused on commercial real estate transactions.

The best golfers in the world are reflective and always finding ways to improve their game, saying things like, “I’m working on my grip, my posture, my tempo.” Similarly, you will find the best commercial real estate associates saying, “I’m networking and building relationships, writing my notes, making calls and setting goals”. In both cases, working on the fundamentals is a key to successful outcomes. BDR is your dedicated team for commercial real estate that brings the proper tools, experience, and drive to achieve your next ‘hole in one.’

Over a decade ago I started working in the commercial real estate profession. Starting something new was exciting and intimidating all at the same time. The same sentiment held true when I adopted golf as a new hobby two years ago. While I wanted to be an expert on my first day playing a round, it became painfully evident that success on the course would take practice to perfect my skills.

Knowledge and experience are very important for both business and golf. In business, it’s important to have a deep understanding of your industry and customers, as well as experience in managing expectations and making strategic decisions. In golf, knowledge of the game and experience with training and practice can help develop skills and improve performance. Another area of focus is relationships.

Several years ago I worked with a church that was new to town and looking to establish a presence. We identified a relatively small office space for their administrative needs and they proceeded to lease temporary space on Sunday mornings for their services. Fast forward three years later and we collaborated again to secure a 15,325-sf facility with an associated 10-year lease. Fostering positive relationships support success for everyone involved.

During my 12 years of experience as a commercial real estate professional, I have developed a deep understanding of the industry, market trends, and customer needs. This has allowed me to build strong relationships with clients and provide them with personalized and effective solutions for their commercial real estate needs. Additionally, my experience has helped me develop exceptional negotiation and communication skills, which are vital in closing deals and ensuring client satisfaction. And while my golf game is still developing, I am confident that my developed skills and strategies in commercial real estate can help you score a ‘hole in one.’

Could you imagine going to the top of a 10,000-foot mountain in shorts and a t-shirt to attempt your very first ski run? That experience would be chilling and potentially dangerous to your health without the proper equipment and experience. Navigating a challenging commercial real estate deal can have similar consequences to your long-term financial health. Just like a mogul on the slopes, real estate deal challenges require swift problem solving and action to successfully navigate the course.

Full-time commercial real estate agents have market knowledge, deal mechanic experience and essential specialty contacts to avoid and navigate the moguls of the commercial real estate world. Attempting to “save a few bucks” on real estate fees may be tempting for some, but often results in a more costly and frustrating end. Traversing the path without experience and proper equipment is risky, so make sure one of your success strategies is teaming up with the right commercial real estate firm to help you navigate a successful deal.

Two recent examples of deals, filled with moguls and challenges, are highlighted below. Spoiler alert: the deal that secured a west coast, 1031 buyer for a second-generation industrial building navigated their moguls with a commercial real estate team of experts.

Black Diamond Realty received a call from an owner who bought a multifamily property roughly 18 months prior to the conversation. Black Diamond had no involvement in that decision/deal. The investor leveraged most of their personal home’s equity to purchase the multifamily property. The assets were located in a strong submarket but the history and ongoing operations were challenging. Since purchasing, the property owner explained they had battled rent delinquency, criminal activity and property damage. Performance was weak. Deferred maintenance was abundant. The tenant situation was challenging.

BDR was asked if they could sell the asset for around the same value that the current owner paid. As part of its due diligence practices, BDR prefers to review three years of profit and loss statements and a current rent roll. Utilizing the income approach to valuing assets, the BDR team can relatively quickly determine a value range they feel is achievable based on current market and property-specific dynamics. After receiving financials, BDR respectfully explained they overpaid and that the current market could not bear their valuation. Black Diamond Realty declined marketing this property.

A long-time client charged Black Diamond Realty with finding a tenant for their recently vacated industrial building. BDR designed a comprehensive professional marketing flyer then maximized exposure via all commercial real estate digital platforms, including its company newsletter (current audience ~6,200). The BDR team proactively reached out to companies who previously expressed interest in similar-size assets and brainstormed end users then pursued them. After entertaining about a dozen tours, the team found the right fit – a company with over 100 locations willing to sign a 5-year lease.

BDR team members led conversations and negotiations on tenant build-out, including amortizing cost over the initial term of the lease. The seller had a long-standing CRE attorney relationship in this case, but BDR typically supports that step as well. BDR reviewed the draft lease and corresponding tenant comments with their client and after several months, secured a 5-year lease with a well-respected company.

Due to other projects and the desire to redeploy capital, the client mobilized BDR immediately to sell the 5-year lease to an investor. Following the same marketing process, the asset was presented as an investment opportunity. BDR secured a 1031, west coast buyer and worked with their broker to navigate questions and concerns throughout the due diligence process. In the end, all parties achieved their goals.

Don’t navigate the slopes alone. Trust the experts. Reach out to Black Diamond today to equip yourself with professional experience, tools, and service for your next deal. The BDR team will provide the advice, contacts, and market knowledge to successfully navigate your next black diamond (ad)venture. Cheers to continued economic growth in a changing investment landscape!

Congratulations! You just rode one of the wildest rollercoasters the modern economy has ever experienced. Roughly one year ago, experts predicted interest rates would begin ticking up twenty-five to fifty basis points, with a target of 4.5 to 5% interest rates. The goal was, and still is, to fight record high inflation (9.1% in June 2022; a 40-year high). Many projections were far off, including ours. In today’s market, a 4.5 to 5.0% interest rate on a deal is unheard of and would make investors drool. As we enter a new year, we are looking at the prime rate hovering in the mid sevens; that’s 7.5%! This marks a 400-basis point increase in the past nine months.[i] Last year experienced the most aggressive economic tightening campaign in over three decades. So, how does that affect commercial real estate?

Rising interest rates put downward pressure on valuations. Financial institutions, including regional and national banks, typically want to achieve a 1.20 to 1.25 debt-service coverage ratio (DSCR), meaning 20%-25% of a project’s cash flow is available to pay current debt obligations. When the cost of borrowing funds increases, meeting required DSCR ratios is more difficult, and a buyer cannot afford to pay as much value to a seller while still maximizing leverage (borrowing power). A buyer either has to come up with more capital to lower the loan-to-value (LTV) ratio or lower the offer price. Here is an example:

ABC Investment LLC has renovated an asset and wants to cash out to redeploy capital into the next project. You like the asset a lot. You offer full asking price – $1,250,000. A bank that requires an 80% LTV ratio (some banks will offer lower, say – 70-75% LTV) will result in you needing to borrow $1,000,000. Nine months ago (Q2 2022), you could have hypothetically achieved an interest rate of 3.65% (Black Diamond often saw rates between 3.25% to 4.00%). Amortizing $1,000,000 over 20 years at 3.65% interest results in a monthly payment of $5,876.97. Fast forward nine months (Q1 2023), and that same loan structure has changed drastically.[1]

As of December 15, 2022, the current prime rate is 7.5% in the U.S., according to The Wall Street Journal’s Money Rates table, which lists the most common prime rates charged throughout the U.S. and in other countries by averaging out the prime rate from the ten largest banks in each country. The federal funds rate is currently 4.25% to 4.50%. With that in mind, you can see how the “fed funds plus 3.00” rule of thumb plays out: 3.00% + 4.50% = 7.50%.[ii] At Black Diamond Realty, we would argue this rate is very conservative, as our experience has resulted in many regional banks willing to entertain deals at lower interest rates – with a 250 to 300 basis point spread in play.

Getting back to our example, your investment company’s new interest rate (7.25%; 275 basis point higher than federal rate) results in a monthly expense of $7,903.76. The difference between a 3.65% interest rate and a 7.25% interest rate is $2,026.79/month. The yearly difference is $24,321.48. In today’s market, let’s assume a regional multi-family asset comps out and sells at a 7% capitalization rate. Utilizing a 7% capitalization rate, the $24,321.48 yearly interest rate difference results in a downward value adjustment of $347,449.71 ($24,321.48 / 0.07). This ~$350K difference results in a seller/buyer “value gap.” Buyers are forced to react quickly because the capital markets respond within weeks, often days. Some buyers are struggling to find deals while sellers reassess their motivations to liquidate. Sellers are realizing they missed the market peak. Buyers are coming to the table with greater liquidity to meet DSCR (healthy, “bankable” deal) and bridge the seller gap.

The current market reflects the seller-buyer gap. On its own, this would be bad news for sellers everywhere. Fortunately for the market, supply and demand also comes into play. Like many things in our economy, construction materials (think Lowe’s, Menards, Home Depot) have experienced significant inflation in 2022. Construction expenses rose 13.7% since September 2021.[iii] Higher construction expenses, including excavation work, have resulted in lower nationwide new housing construction starts. Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,427,000. This is a 0.5 percent below the revised October estimate of 1,434,000 housing starts and is 16.4 percent below the November 2021 rate of 1,706,000.[iv]

The same trend is true across most sectors of commercial real estate. Higher material costs combined with higher costs of borrowing funds (interest rates) has resulted in a slowdown of new construction activity. We anticipate this trend to continue. Sticking with the multifamily sector, lower housing starts have resulted in increased rents and corresponding increased valuations. The same data shows a downward trend in construction costs during Q4, 2022 which is something to watch in 2023. So, what else can we expect in 2023?

Deals happen in all cycles of commercial real estate. Rising interest rates create downward pressure but, on the flip side, rising rents/income result in higher valuation. Do these two opposite effects counterbalance each other? The answer is specific to each commercial real estate sector (supply/demand) and the specific market. Depending upon the market, rising income is outpacing inflation which continues to push rents higher. The risk lies in the job market. Job loss and higher unemployment will eventually reduce consumer purchasing power and result in less demand for materials, goods and real estate. When unemployment rises, rent growth will be at risk for most sectors of commercial real estate. Our team is keeping a close eye on unemployment in 2023.

The ‘R’ word has been tossed around many dinner tables and watering holes across America. An economic recession occurs when GDP, which measures trade and industrial activity, declines in two successive quarters. Are we amid a recession? US Government courses reported that Quarter 3 of 2022 saw a 3.2% increase in GDP over the previous quarter.[v] This increase is welcoming news after two quarters of declining GDP. Some fear the data is artificially inflated due to the government’s easing of energy costs. The biggest challenge in reviewing federal government data is the lag. Most data lags at least three months, sometimes six, which means the Fed is making decisions based upon outdated information. What does the real estate market cycle forecast look like knowing this? Keep reading.

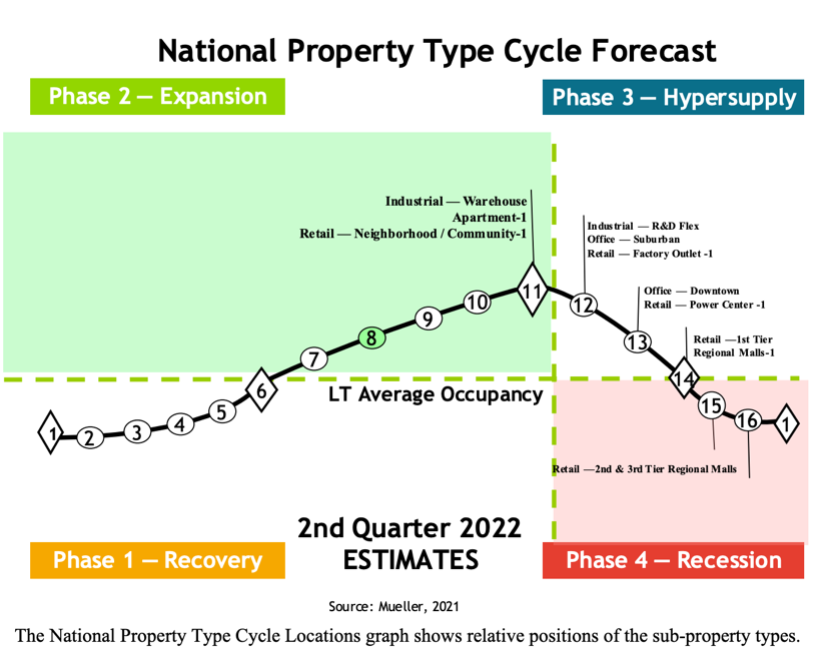

Real estate market cycles vary by sector and location, amongst other factors. Mueller’s[vi] forecasting model breaks down the real estate market cycle into four phases:

Mueller’s Real Estate Market Cycle Forecast, As of Q2-2022

There are 16 total points along the horizontal axis. Points 1-11 are in phases 1 and 2 which represent a period of growth. Points 12-16 are in phases 3 and 4 which represent a period of decline. The four market cycle quadrants have varying characteristics. Phase 1, Recovery, is characterized by declining vacancy with little to no new construction. Negative rental growth to below inflation rental growth is expected during this part of the cycle. Phase 2, Expansion, is characterized by declining vacancy with greater new construction. High rent growth is common. Phase 3, Hypersupply, is characterized by increasing construction with continued and/or increasing construction. Rent growth remains positive but begins to decline. Phase 4, Recession, experiences increasing vacancy with more completions. Below inflation and negative rent growth is experienced during this part of the cycle. The Mueller report’s primary objective is to enhance investment decision analysis – to make investors aware of national trends.[vii]

Sector breakdowns are provided in the bullet points below with quick comments about the regional market. Keep in mind what is happening in New York City, NY is not necessarily a direct correlation to what is happening in Bridgeport, WV; hence several anecdotal comments from Black Diamond Realty’s perspective which are focused on the two core areas we serve: North Central WV and WV’s Eastern Panhandle. We recommend referencing the chart as you review the points below. Mueller’s data is the black bullet points. Black Diamond’s points are white sub-bullet points. In addition to this distinction (national trend – Mueller vs. Black Diamond), bear in mind Mueller’s chart lags by two quarters. The cycle has progressed along the bell curve over the past three to six months.

Point 11: Peak of Phase 2 – Expansion Cycle

Point 12: Beginning of Phase 3 – Hypersupply

Point 13: Middle of Phase 3 – Hypersupply

Point 14: End of Phase 3 – Hypersupply

Point 15: Middle of Phase 3 – Recession

Predicting future trends is nearly impossible. Market dynamics are complex and can shift quickly. Our team of experts has made some observations and anticipations for 2023. In no way, shape or form are we suggesting these “educated guesses” to be fact. Mere predictions are not indicative of actual future results. Please consult with your professional legal and financial advisors, complete your own due diligence and draw your own conclusions pertaining to the best financial moves for you.

Black Diamond Realty Predictions:

Real estate is considered by many as a great hedge against high inflation and a strong diversification play. Income producing assets are still warm, not hot, as an investment diversification play. Activity has cooled due to higher interest rates putting downward pressure on valuations. Ranking the sectors is difficult because there are so many factors (location, age, tenant, traffic patterns, surrounding amenities, etc.) but anticipated trends can be projected. In addition, there are several macroeconomic and microeconomic items we anticipate playing out in 2023.

We recommend each party consults with its professional accountant, tax, and legal advisors to better understand the effects of market conditions and real estate transactions. Primary keys to successful investments are knowing the market, the numbers and market trends. Our professional team at Black Diamond Realty is an industry leader. Our company mission is to add value to the communities we serve. We look forward to consulting with you in 2023. Make it a successful investment year.

[1] It should be noted that interest rates can change drastically depending upon many factors, including the deal’s strength, the borrower’s financial strength (including investment and business experience), debt-to-liquidity ratios, and LTV.

SOURCES

[i] https://www.jpmorganchase.com/about/our-business/historical-prime-rate

[ii] https://www.forbes.com/advisor/investing/prime-rate/

[iii]https://www.bls.gov/opub/ted/2022/producer-prices-for-final-demand-rose-7-4-percent-over-the-year-ended-november-2022.htm

[iv] https://www.census.gov/construction/nrc/pdf/newresconst.pdf

[v] https://www.bea.gov/data/gdp/gross-domestic-product#:~:text=Gross%20Domestic%20Product%20(Third%20Estimate,(Revised)%2C%20Third%20Quarter%202022&text=Real%20gross%20domestic%20product%20(GDP,percent%20in%20the%20second%20quarter

[vi]https://www.ccim.com/uploadedfiles/content/members/cycle%20forecast%202q22.pdf

[vii]https://www.ccim.com/uploadedfiles/content/members/cycle%20forecast%202q22.pdf

[viii]https://www.cnn.com/2022/12/21/economy/consumer-confidence-index-december/index.html#:~:text=Consumer%20confidence%2C%20as%20measured%20by,inflation%20seen%20in%20four%20decades

Article by:

David Lorenze, Principal

5000 NASA Blvd, Fairmont, WV

Located within the I-79 Technology Park, 5000 NASA Blvd is a 114,055 (+/-) square foot building with multiple office suites available ranging in size from 1,622 (+/-) to 14,740 (+/-) square feet. This building is separated and identified as North Tower and South Tower. There are two elevators within each tower. The I-79 Technology Park houses multiple office buildings and is HUB Zone Certified. The property offers signage availability, and ample courtesy parking for visitors and employees.

The High Technology Park is located within the heart of the I-79 High Technology Corridor just south of Fairmont, West Virginia. The location of the I-79 Technology Park places it within one day’s drive of 60% of the U.S. population and some of the Nation’s largest cities including New York, Boston, Washington, Chicago, Atlanta, Charlotte, Philadelphia, Baltimore, Pittsburgh and Indianapolis. Access to I-79, Exit 132 can be achieved by traveling 0.8 mile southeast. The building and park are highly visible from traffic traveling in both directions along I-79.

Asset Highlights

View our detailed marketing flyer to see available suites, interior photos, floor plans and more.

________________________

1000 Technology Drive, Fairmont, WV

Located within the I-79 High Technology Park, 1000 Technology Drive (Innovation Center) is a 102,723 (+/-) square foot building with multiple office suites available ranging in size from 779 (+/-) to 6,337 (+/-) square feet. The I-79 Technology Park houses multiple office buildings and is HUB Zone Certified. The property offers high security, high end finishes, reception desk attended during office hours, free parking, conference/training room with WIFI, projector, fitness center, group fitness classes, large outdoor courtyard.

The High Technology Park is located within the heart of the I-79 High Technology Corridor just south of Fairmont, West Virginia. The location of the I-79 Technology Park places it within one day’s drive of 60% of the U.S. population and some of the Nation’s largest cities including New York, Boston, Washington, Chicago, Atlanta, Charlotte, Philadelphia, Baltimore, Pittsburgh and Indianapolis. Access to I-79, Exit 132 can be achieved by traveling 0.5 mile southeast. The building and park are highly visible from traffic traveling in both directions along I-79.

Asset Highlights

View our detailed marketing flyer to see available suites, interior photos, floor plans and more.

___

Additional Articles;

Black Diamond Realty is proud to announce that we have officially closed on an office building along N Queen St in Martinsburg WV. Our talented Graphic Designer/Office Manager, Andrea Icenhower is permanently servicing this office along with David Lorenze and Kim Licciardi who travel from our headquarters in Morgantown WV. We are excited about the expansion of our business and will continue to uphold our commitment of ensuring the success of our clients and community. Stay tuned for more updates on the renovations of our office space and official address.

In the meantime, our Black Diamond Realty team is available and ready to help serve you. Please call Black Diamond Realty’s Martinsburg (304.901.7788) office to speak to Andrea and set up a consultation to discuss your commercial real estate needs.

Our team sees a growing need in the Eastern Panhandle for a specialized commercial brokerage firm. The Eastern Panhandle community is rich in history. Serviced by I-81, WV’s Berkeley and Jefferson Counties represent an abundance of growth, serving as the main connection between the Washington, DC / northern Virginia area and the beautiful mountains of West Virginia. We are excited to expand our team and our approach to the area.

In the beginning of August, our Graphic Designed/Office Manager Andrea and her husband Michael Icenhower packed up a Uhaul and moved to the eastern panhandle where Andrea will head the new office. Andrea recently joined the Leadership Jefferson program which is sponsored by the Jefferson County Chamber of Commerce – Jefferson Co Chamber Facebook – The Primary goal of Leadership Jefferson program is to educate current and future community leaders about JeffersonCounty’s assets, opportunities, and hurdles, to strengthen the sense of community and ensure a prosperous future.

Andrea and her other classmates will continue to meet through June 2023 to learn more about the community and to meet businesses in the area! The class of 16 will continue to work together on a class service project! We can’t wait to see what they come up with!

For many Americans, these feelings and beliefs have embedded themselves into our cultural fabric. Reminders of uncertain, and for many, challenging times are plentiful. Gas pump prices have soared over the past 12 months. A gallon of milk is 11.2% higher in the same time period. Your favorite morning coffee tastes a little less fulfilling with the higher price tag. Our society has shifted from one cultural extreme to another – enduring a long stay-at-home mandate that stressed the core of human interaction needs to an economy flooded with out-of-control inflation. Why is this happening? What comes next? Our team of experts has thoughts and ideas. Before reading further, please know these thoughts, beliefs and predictions may make you uncomfortable. They are observations and beliefs; not a crystal ball reading. Time will tell how things play out.

Rich or poor, black or white, urban or rural – nobody is immune from its unwanted presence and the corresponding challenges it creates. Every month, the federal government reports inflation data in several different ways. As commercial real estate specialists, our Black Diamond Realty team pays close attention to the CPI, which stands for Consumer Price Index. The CPI recently hit multi-decade highs at 9.1% or (https://www.npr.org/2022/07/13/1111070073/no-retreat-in-the-summer-heat-prices-likely-topped-40-year-high-last-month). For perspective, dating back to 1913 (but first published in 1921), the CPI’s historical average is ~3.3%. For even greater perspective, the decade from 2011-2020 experienced total inflation of 17.3% which is an average of 1.73% per year. Reflecting upon recency which tends to dominate human thinking, in the past 12 months, we have experienced the equivalent of five plus years of inflation packed into one year (1.73% x 5 years = 8.65%).

Most of our nation’s current inflation can be pinned to two primary factors. The first factor is stimulus money. The federal government injected over $5 trillion into America’s money supply over a 24 month period via Covid relief funds. This amount represents roughly 27% of the current money supply in circulation. More money in citizen pockets led to increased spending. The higher velocity of spending creates inflation. To combat this velocity, the federal government utilizes one of its key control levers, interest rate fluctuation, to control spending habits. The goal of increasing interest rates is to decrease spending in an effort to slow down the economy. The Feds recent rate increases illustrate the government’s concern that inflation is running too hot. The impending challenge is the Fed’s interest rate hikes are only geared toward addressing the demand (spending habits) side of the equation. It does not address the supply side. The Fed faces an unprecedented task of reining in high inflation with 40% additional money in play.

Simply put, our dollars today are significantly less valuable (lower purchasing power) than they were 12 months ago. Stimulus money aims to help those most in need; those individuals most vulnerable and lowest on the earning potential food chain. The irony is disheartening… Our government over-injected for short-term benefit, thereby creating a long-term inflation challenge. The band aid (government stimulus checks) has been pulled while the wound has intensified. Printing money and more government spending is it the answer to stop the bleeding.

Under President Biden, an extreme focus on sustainable, clean energy has resulted in an under supply of oil and gas. In the long run, most agree this will be better for our planet and the sustainability of our nation. Others will point out this goal is a multi-decade process to reach a level of production and reliability to avoid power shortages and blackouts. In the short term, President Biden’s regime eliminated the ability to drill on most federal lands. The recent stay-at-home mandate also resulted in lower power consumption which led drilling companies to halt operations. Sanctions placed on Russia are also in play. The following article goes into great detail about how high energy costs greatly affect inflation: https://www.nytimes.com/interactive/2022/06/14/business/gas-prices.html

It is impossible for any individual to look into their crystal ball to decipher the outlook 1, 3 or 5 years out. Nonetheless, our team has put together a list of educated guesses.

Please note that statements based on forward-looking estimates may not materialize; there are no guarantees of future economic performance.

Warren Buffet has profited billions with a simple, straightforward investment strategy. Fear creates irrational decisions which lead to opportunities. “Buy when there is fear in the market.” The world’s current fear, uncertainty and challenges will result in tremendous buying opportunities.

The fundamentals of successful commercial real estate investing is changing. Our team of experts recommends keeping the following tips in mind.

We live in a world of challenges. Fear and anxiety are at all time highs for some. We survived the 1973-81 recession and will certainly overcome the present day’s hurdles. The United States has proven, many times over, to be a dynamic and resilient culture with the ability to overcome adversity. Proceed with caution, be prepared to pounce and consistently monitor opportunities. Buckle up. Remember rainbows only show after periods of rain. Challenging times present wealth building opportunities.

Our Black Diamond Realty team can help guide you. Please call Black Diamond Realty’s Morgantown (304.413.4350) or Martinsburg (304.901.7788) office to set up a consultation with one of our experts.

Article by:

David Lorenze, Principal

Nine out of 10 US millionaires have found tremendous financial success in real estate investment. Read the seven reasons why 90% of millionaires choose to invest in real estate and why you should too in this article.

The federal government’s rules and regulations offer favorable incentives including annual depreciation and interest expense deductions. These tax deductions encourage investors to deploy money into real estate. The most favorable, generational wealth building tool can be found in Section 1031 of the IRS code. According to IRS.gov,

Whenever you sell a business or investment property and you have a gain, you generally have to pay tax on the gain at the time of sale. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange.

A 1031 exchange allows a real estate seller to defer paying taxes so he or she can leverage capital gains into a larger asset with presumably greater cash flow. The IRS essentially allows an investor to ‘kick the can down the road’ and reinvest the government’s money via a 0% interest loan. The taxes do not disappear, but an investor has the opportunity to leverage the government’s money into larger assets. The 1031 program rewards investors while encouraging further investment in real estate.

This is one of the greatest wealth building tools that exists, because there is no limit on the number of times an investor can utilize a 1031 tax exchange. The federal government is also flexible on the definition of a like kind property. For example, you can sell an apartment building and purchase an office building, land, industrial building, or an asset in a different sector of real estate. To qualify for a 1031 like-kind tax exchange, there are important rules and regulations that must be met. Identification timeframe and the process are two key items to understand.

The government offers two primary identification methods for a 1031 exchange. Both methods require the seller to utilize an intermediary to quarterback the process. Some intermediaries specialize in only 1031 transactions. Other investors choose to utilize their preferred real estate attorney, whose firm is capable of handling a 1031 transaction. To execute a 1031, it is imperative the exchanger (seller of relinquished property) hire an intermediary who handles the 1031 transaction, before the relinquished property closes. A 1031 is considered null and void if the seller (of the relinquished property) takes position of the funds from the relinquished asset sale. More information about the top ten identification rules for a 1031 exchange can be found here.

The traditional 1031 method allows for a 45-day requirement to identify and designate property to purchase, once the relinquished property has sold. There are two “identifying” rules that govern how many properties can be identified. The first rule allows an exchanger to identify up to three properties to purchase. The second method allows an exchanger to identify as many properties as desired, up to 200 percent of the value of the relinquished asset. The second timeframe rule pertains to total days to purchase the replacement asset(s). From the sale of the relinquished asset (property sold), you have 180 days to finalize a transaction to purchase a replacement property or properties.

The second method to execute a 1031 occurs when the exchanger buys “replacement assets” before the relinquished property is sold. A reverse 1031, as implied, is effectively the reverse order of a traditional 1031. This option takes more time and is more cumbersome from a paperwork/process standpoint. The replacement asset(s) are purchased first and held by an intermediary. Then, the 1031 applicant has 180 days to close on the asset. Why would anyone utilize a reverse 1031? Black Diamond Realty recently experienced a situation, whereby a client secured a purchaser for a parcel of land and the client wished to defer capital gains tax payment. So, the client secured two replacement properties via a purchase and sale agreement. The land contract needed to be extended multiple times. After six months, the seller of the replacement assets (our client was the buyer) applied pressure for the multifamily properties to sell immediately. In addition, our client wanted to close on those assets, because we were in a rising-interest-rate environment. Our client closed on the two multifamily “replacement assets” before finalizing the sale of his land (cause for the capital gain to be in play), resulting in a reverse 1031 being executed.

Black Diamond Realty recommends you consult with your accountant or tax advisor and a real estate attorney before finalizing your like-kind exchange strategy. BDR has many on-market and off-market replacement opportunities. So, please utilize our team as a resource. Wealth building tools have been created to incentivize folks to invest in real estate. Be aware of their availability and utilize them to meet your investment goals.

Article written by:

David Lorenze, Principal

As our post-pandemic world continues to innovate and evolve, so too does Black Diamond Realty. Over the last year, we have seen an increase in demand for our expertise and services across all sectors and locations in West Virginia and Southwestern PA. We work hard to understand the markets we serve. Our team sees a growing need in the Eastern Panhandle for a specialized commercial brokerage firm. We are thrilled to announce our official presence and intent to open an office in 2022 to serve the Eastern Panhandle.

The Eastern Panhandle community is rich in history. Serviced by I-81, WV’s Berkeley and Jefferson Counties represent an abundance of growth, serving as the main connection between the Washington, DC / northern Virginia area and the beautiful mountains of West Virginia. Despite the pandemic-created economic challenges, the Eastern Panhandle persevered as an economic engine for the state and is in the midst of an economic boom across all commercial real estate sectors. For these reasons, we believe the time is now to make an impact and to begin serving these communities.

At Black Diamond Realty we pride ourselves in providing clients with the highest quality service. Our motto is, “Real Service. Real Value. Real Results.” Black Diamond Realty opened its doors on October 1, 2013. As of 2022, the team has a total of 106 years combined experience, which includes three graphic designers who ensure our team’s presentation and process exceeds expectations. In 2021, Black Diamond’s team closed 88 transactions equal to $66,766,420. For each project, the Black Diamond team accepts the challenge, diligently and aggressively executes its process, and navigates the nuances associated with completing a successful commercial real estate transaction.

We are excited to be bringing our team and our approach to the Eastern Panhandle. Black Diamond Realty embraces community engagement and collaborating with industry leaders.

The Eastern Panhandle office will be spearheaded by David Lorenze (Principal), Kim Licciardi (Senior Associate), and Andrea Cooper (Jr. Graphic Designer/Office Manager). These individuals are all integral parts of the Morgantown team and bring years of experience and expertise to this new location. Black Diamond Realty will be actively recruiting new commercial sales associates in the area over the coming months. Have questions about our new Eastern Panhandle office? Give us a call at 304.901.7788.

Article by Kim Licciarid, Senior Associate

Macroeconomics (think interest rates and national productivity) greatly impact the commercial real estate markets we serve. Three major macro topics of 2021 were inflation, interest rates and labor participation. The most recent data released by the federal government indicates year-over-year inflation is at 6.2%, which is a rise from the previous quarter’s 5.4% and a multi-decade high. From higher price tags at the gas pumps to greater expense at the grocery store, inflation causes the dollars we have in our possession to have lower purchasing power.

The current rate of inflation has initiated discussion about interest rate increases to combat inflationary concerns. Historically, the federal government has utilized one of its key monetary policy levers, interest rate control, in high inflationary periods. The Federal Chairman, Jerome Powell, and his team anticipates three interest rate hikes in 2022 and another three in 2023. BDR projects interest rates to rise 75 to 125 basis points in 2022. On average, BDR has seen commercial real estate interest rates hover around 3.5% (3.25% – 3.75%) in 2021. If BDR’s projected 2022 increase is accurate (utilizing 1% interest rate increase), a $1MM loan will be $6,322.68 more per year when amortized over 20 years.

In 2021, BDR saw a significant increase in demand for investment commercial real estate. Investors are looking to diversify. Low interest rates is one key reason. Other contributing factors include high inflation, speculation the stock market is due for a correction and investors desire to move into tertiary/rural markets. Black Diamond Realty’s thoughts behind these contributing factors include:

The factors above have resulted in compressed cap rates and corresponding higher valuations. It is a great time for a seller to exit an asset while a difficult time for purchasers to find deals. Black Diamond Realty has experienced a significant increase in off-market deal activity and we anticipate this trend to continue.

North central WV and southwestern PA are enjoying many economic highlights as our nation moves further beyond the Covid pandemic. Some of the north central WV highlights are captured below.

BDR worked hard to achieve its clients’ goals in 2021. The BDR team closed 87 deals in 2021 with 61% leases versus 39% sales. BDR added a new colleague, Caleb Wooldridge, to our growing team. Caleb joins BDR as a recent WVU graduate who majored in Economics and interned with David as an undergraduate. We are excited to watch Caleb flourish in the years ahead.

In his fourth year, Jeff Stenger continues his climb by surpassing production year after year. Jeff’s empathetic, hard-working and detailed-oriented demeanor adds tremendous value to the clients he serves.

Chris Waters has been dubbed the medical marijuana and industrial guru in BDR’s office. Last year was a breakout year for Chris and 2022 looks to continue that growth.

In her first full year with the team, Kim Licciardi set a BDR record for Year 1 production. Kim’s underwriting knowledge, business acumen and confidence have quickly propelled her onto a path as a top producer.

BDR’s sales team would not be where it is today without the skillset, support and moral fabric that Janelle Zeoli and Andrea Cooper provide daily. These two women are invaluable to the BDR team and continue to support our growth and development.

As we close the 2021 chapter, we are pleased to announce BDR is aggressively and actively working toward opening a second office in Martinsburg, WV. We will be recruiting and hiring key team members in the market with a specific focus on fostering client relationships and fortifying vendor contacts. We are optimistic our presentation, process and people will be well received in this new market. There will be more to come in a future announcement.

Our team promises to continue to strive to raise the standard while exceeding expectations in this new year and beyond. Thank you for your trust and confidence and we look forward to making 2022 a great year, together.

View our July Newsletter: BDR’s Q2 Closed Transactions Are In!

View our June Newsletter: Inflation Uptick…Here’s What to Expect

The recent pandemic has caused significant construction supply chain challenges. Material costs have increased drastically; lumber futures are up 280%, steel mill product costs are up 55.6%, and gypsum product costs (plaster, drywall) have increased 12.5%. On top of the cost increase, lead times for construction materials have doubled or tripled, in many cases.

One example to offer…a BDR client recently called a contractor for a 6,000 square foot build-to-suit retail structure. Upon giving the bid, the contractor stated, “We will hold this pricing for two days.” This is in stark contrast to the typical pricing hold of 30 days. The urgency on both sides is a result of supply chain challenges.

Tensions like these extend beyond material cost increases. The Federal government recently injected an estimated $6 trillion dollars into our economy. Many businesses, communities, and families depended on this money to sustain their livelihood during the government shutdown. While the government took this step to rescue our economy in the short-term, the long-term impact should not be overlooked.

Inflation is a reality we will face in the years to come. Dating back to 1914, the yearly inflation rate in the United States has averaged 3.23%. The highest single month of inflation was in June 1920 when it skyrocketed to 23.70%. Since 2009, inflation has averaged 1.5-2% per year. According to tradingeconomics.com, April 2021’s inflation (most recent data point) is 4.2%. Each month in 2021 has seen an upward inflation trend.

There are several reasons inflation can uptick. Some of the causes include:

These signs and more point to high rates of inflation. The volume of currency (USD) circulating in our system, pent-up demand for product and current supply chain issues are key indicators of increased inflation, which means tomorrow’s dollar will be worth less than today’s dollar.

One way to invest smartly given this circumstance is an inflation hedge. An inflation hedge typically involves investing in an asset expected to maintain or increase its value over a specified period of time. The investment goal is to secure assets close to, at, or greater than the rate of inflation. Investors should weigh their options across all investment opportunities.

Real estate is considered a strong hedge against inflation because property values and rents typically increase during times of inflation. Real estate has intrinsic value, is in limited supply, and is a yielding asset. People need to have shelter regardless of the value of their currency. Real estate investing also allows investors to utilize other people’s money, include the banks’, to make money.

Interest rates are still hovering around all-time lows which makes real estate a particularly attractive option in the current investment environment. When the rate of inflation goes up, fixed-interest rate financing costs less than when the loan was taken out since the dollar has lost some of its value. The borrower is essentially paying the lender back money that’s worth less than when the borrower took out the loan. This allows investors/borrowers to pay back loans using cheaper dollars.

“A dollar today is worth more than a dollar tomorrow.”

At Black Diamond Realty, we have seen an uptick in demand for multifamily assets and other investment properties, income producing assets, across all sectors. We anticipate this trend to continue due to many of the reasons highlighted in this article. West Virginia has received tremendous positive economic momentum. From the Hyperloop announcement to the Smith’s Ascend WV program, momentum is building in WV. North Central WV remains an economic shining star in the state.

Call Black Diamond Realty today to explore your investment options. We have a team of professionals who understand complicated dynamics driving the various markets we serve. Let us underwrite your next investment project. Hedge against inflation wisely.

Article by: Article by: David Lorenze, Caleb Wooldridge Edited by: Dr. Stephanie Lorenze

View our May Newsletter: Black Diamond Takes Key Largo!

View our April Newsletter: Q1 Closed Transactions | New Development Announcement

View our March Newsletter: New Sports Complex coming to Bridgeport this summer

View our February Newsletter: Buyer-Tenant Representation: How Black Diamond Realty Can Assist You

Choosing the commercial real estate that is the best fit for you and your success can be tricky. Does the location align with the business’ demographic focus? How will visibility and accessibility positively or negatively influence the business’ performance? What deal structure preserves capital while minimizing long-term risks? These are a few examples of many challenging and complex questions that should be thoroughly analyzed when striking a commercial real estate deal.

Black Diamond can be your commercial real estate parachute. Our team of experts adds value to a buyer and/or tenant representation relationship by providing sound market and experience-driven advice, utilizing resources to thoroughly canvass the market for all assets which potentially service your needs, advocating for your best interests during the negotiation process, connecting you with helpful professionals, and taking a comprehensive, team-oriented approach focused on looking out for your best interests. Our team works hard to service and protect our clients’ interests.

Commercial real estate transactions are complex with many potential hurdles. The information below is intended to expand upon reasons you should consider securing buyer and/or tenant representation when searching for your next commercial real estate asset.

Whether you are in the market for investment assets, office, industrial, land or retail space, we will assist you with finding the right location and property. Clients benefit from our market knowledge, putting them on the inside track to evaluate locations, rental rates and purchase prices, negotiate lease and purchase agreements, and assess other pros/cons. We specialize in finding properties that are off market or not advertised as available, and we can recommend knowledgeable attorneys, architects, engineers, contractors, accountants, and other professionals to assist any purchase or lease transaction.

We understand that every situation is unique, ranging from large corporations to small local businesses, which is why we tailor our approach to meet the needs of each industry. When you choose Black Diamond as your buyer-tenant representative, you will gain support from a brokerage firm that will help you achieve you short or long-term goals.

If your business’s lease is near expiration or you’re looking to relocate or expand, call us today at 304.413.4350 and we will assist you in evaluating a new location for success!

View our January Newsletter: Reflecting and Projecting: 2021 Real Estate Predictions

View our April Newsletter: BDR is OPEN and Ready to Help

View our March Newsletter: White Diamond Realty – BDR’s Residential Partner Is Active!

For David Lorenze and Mark Nesselroad, principals of commercial real estate company Black Diamond Realty LLC, starting a residential brokerage was a no-brainer for the pair. “We grew to be the commercial bridge with national [commercial real estate] firms and had formed a great team,” Nesselroad said. “We saw an opportunity to serve the residential market.” “Our outreach makes us different.” Lorenze agreed. “We are excited to utilize Black Diamond Realty’s presentation, process and people to develop a new organization focused on residential brokerage services,” Lorenze said. “Securing a well-respected, strong leader was a critical first step.”

The result of that opportunity is the recent formation of White Diamond Realty LLC, Black Diamond’s new real estate arm. And to lead their new residential venture as its broker, the principals tapped Melissa Berube, a veteran Morgantown area realtor who was the 2019 president of the Morgantown Board of Realtors.

“Melissa brings to the table a strong reputation, a charming demeanor and an unwavering work ethic, which we are confident will lead to tremendous results. … We are excited to see what the future holds and appreciate the community’s support,” Lorenze said.

At White Diamond, Berube, who has been selling homes for nearly two decades, is being tasked with recruiting and building a team of seasoned agents who know the local real estate market and are tech savvy. The White Diamond agents will be based at Black Diamond’s Stewartstown Road headquarters.

“I am excited to be building something new,” said Berube, who was previously with Howard Hanna Real Estate Services Cheat Lake office. “I am working on the foundations now,” she said. “Our goal is to become a boutique agency that emphasizes quality over quantity.”

Berube said she is looking at recruiting more than a dozen agents at White Diamond, a goal she hopes to accomplish by spring. She sees White Diamond’s niche mostly as second-time home buyers, or transition buyers who are new to the area. “Experience is always good, but I would consider a newbie,” said Berube, when asked about the kind of residential agent she hopes to recruit. The agents who join White Diamond will be incentivized and encouraged to work together as a team — a concept important to Black Diamond, she added.

“For us, it’s all about team building,” said Nesselroad, who also serves as the chief operating and legal officer of developer Glenmark Holding LLC. “Starting a residential company has been in the backs of our minds for a while.” It also helps to have Berube as its residential broker, he said. “We have full faith and confidence in Melissa Berube to lead our team.”

Article By: Suzanne Elliott, The Dominion Post

In the coming months, many will begin setting new yearly goals which may include traveling with family and friends, pursuing new business ventures, giving to charity or sculpting your body. Many things in life, goals included, require time and/or money. In our professional careers, each of us is consistently trading time for money. What if the opposite could be true?

Money is an empowering tool that, if utilized properly, can enact positive change and help facilitate positive outcomes. Money is necessary to live your life and allow you to enjoy adventures, conquer goals and achieve dreams. Is there a way to trade money for time? How do you get out of the rat race while making enough money to live your life on your terms? There is no easy answer but diversifying your investments to include real estate could offer passive income. Passive income can help you achieve financial freedom (more money coming in each month than your expenses) and “buy” more time.

According to The College Investor, “Over the last two centuries, about 90 percent of the world’s millionaires have been created by investing in real estate.” This is a staggering statistic: 9 out of every 10 millionaires created their wealth through real estate investing. Real estate investing is not a “get rich quick” scheme. Real estate investing utilizes leverage, compounded over time, to an investors’ advantage resulting in long-term wealth. If purchased and managed correctly, an income producing asset should be working for you every second of every day.

With the above in mind, it is imperative to fully understand there is risk associated with real estate investing. Commercial real estate investing is a complex process with many potential pitfalls. We recommend consulting with trusted advisors before solidifying your next investment. Black Diamond Realty’s tips are meant to guide your real estate investments toward positive cash flow, wealth creation and passive income. The tips below provide some general guidelines to consider as you expand your portfolio or kick things off in a successful real estate investment venture.

Following the guidelines outlined in this article should help avoid investment pitfalls during ownership. Knowing when to buy, hold and divest is another critical element of real estate investing. We highly recommend consulting with a real estate professional, with strong expertise in the investment field of your choosing, before pulling the trigger. At Black Diamond Realty, we have sold tens of millions of dollars in real estate investments. Our firm is building a market niche in this space. Our Black Diamond Realty team invites the opportunity to meet with you and your partners to discuss your goals with the purpose of helping you achieve financial freedom.

To view all of our available investment opportunities, Click Here.

Article by David Lorenze.

View our October Newsletter: Few Opportunities Remaining at I-79’s Hottest Exit…

Mon Health EMS officials were at The Gateway on Sept. 20 to show off their new digs — a two-story, 15,780 square-foot facility that serves dual roles as doctor’s office and EMS substation.

While the majority of the building houses Wedgewood Family Practice, roughly 1,000 square feet of the building contains a drive-through vehicle bay large enough for two ambulances and the needed accommodations — a day room with a kitchenette, seating and television, office space with multiple work stations, storage and restroom facilities.

Mon Health EMS Director Dave Custer saidEMS operations began rolling out of the new facility earlier this month. “This is replacing and upgrading our station we had in Osage,” he said. “It’s a better location for us to respond, not only to the interstate quickly, but to Star City, Westover and the Blacksville area.” Custer said one ambulance is operating out of the new building, but a second could be added permanently or temporarily in the event of anticipated traffic disruptions or other circumstances. He went on to say that Mon Health EMS is looking at the Grafton Road area and the Pierpont/Cheat Lake area for additional ambulance staging locations.

The agency already has an agreement with the Blacksville Volunteer Fire Department that allows an ambulance to be staged at the fire station. “By having stations out in all four quadrants of the county, we really can cover this county pretty well,” Custer said. Mon Health invested $5 million to build and equip the entire facility.

Ben Conley, The Dominion Post

__

View our September Newsletter: Award Winning Investment Opportunity Revealed

“It’s unbelievable,” Dr. Jodi Lindsey, center director, said of the 9,000 square foot space on Baker’s Ridge Road. Lindsey said there’s always been a need for this type of service in West Virginia and her dream, even before medical school, was to build a center like this. The center brings all levels of child neurodevelopmental disability treatment under one roof including diagnosis and evaluation, medical workup and treatment and therapy services she said.

Albert Wright,president and CEO of the West Virginia University Health System, said the center was designed for a very specific purpose – helping pediatric patients with neurodevelopmental disabilities. Those disabilities include Autism Spectrum Disorder, developmental delay, cerebral palsy, and Tourette Syndrome. The best treatment is “intensive and early behavioral intervention,” Nikki Shriver, an applied behavior analyst (ABA), said.