What To Know About 1031 Tax Exchange

At Black Diamond Realty, one of our goals is to educate our clients and help them build wealth over time via real estate investments and holdings.

Tremendous perks exist in real estate that are not available through investing in stocks, bonds or other investments. One of those major perks is a 1031 tax exchange. A 1031 tax exchange can be described as a real estate transaction without immediate tax implications to the seller.

It is important for you to understand your tax bracket and effective tax when completing a 1031 transaction. You do not simply sell an asset and walk away with the net amount on the closing statement. Your transaction is, most likely, subject to capital gains and depreciation recapture. We recommend all clients consult their accountant to better understand the ins and outs of their tax liability associated with any contemplated transaction. With that disclosure in mind, consider how a seller’s capital gains tax liability is one wealth building tool permitted by the federal government.

In a traditional transaction, the seller is subject to capital gains and depreciation recapture. This article is only focusing on capital gains. A capital gains tax is defined as a tax on the increase in the value of an investment. Short-term capital gains are characterized as gains from a sale in which an asset was owned for less than one year. Short-term capital gains are taxed according to your income tax bracket (seven total tax brackets in 2018). Long-term capital gains are classified as monetary gains in which an asset was owned for more than one year.

For single filers, the capital gains tax rate ranges from 10% to 37% for short-term capital gains versus 0% to 20% for long-term capital gains. Check out the charts (single versus joint filing) to get a better understanding of your potential capital gains tax obligation if you sell real estate. In addition to the capital gains tax outlined in the chart, high earning individuals (making $200,000+ filing individually or $250,000 filing jointly) are subject to an additional 3.8% tax which the government calls the “net investment income tax”.

So, you may be saying, “I get the tax percentages and know where I fall, but how do the numbers look in a real-world example? And, is there any way I can defer these taxes?”

Let’s take a look at an example. You are successful entrepreneur who found an office building for $500,000. Over the years, the asset increased in value as the economy grew and the market improved. Seven to eight years (average hold on a commercial asset) after your initial purchase, you agree to sell the asset for $1,000,000. In this example, you are facing a capital gain of $500,000. (The basic formula for calculating your capital gain is to take the basis sale price minus the property’s basis (purchase price +/- depreciation, amortization, improvements and selling expenses). The net amount is your capital gain.)

Review the chart above to see what your tax liability would be. We will assume the top capital gains tax rate of 20% plus the 3.8% (net investment income tax). In this example, your federal capital gains tax would be a total of 23.8% which is $119,000. That’s right… $119,000! So, your gain goes from $500,000 down to $381,000. This sounds like a lot of money but your accountant will remind you that is not the money you get to keep. Your accountant will need to give you the calculation for the depreciation recapture you owe. The term is exactly as it sounds… You need to recapture the “paper write-offs” you have been taking over the years, via “depreciation” tax reductions and repay them. Whew, are we done? Not yet. You also need to remember state taxes will apply. Having a trusted real estate accountant is a must when investing in real estate.

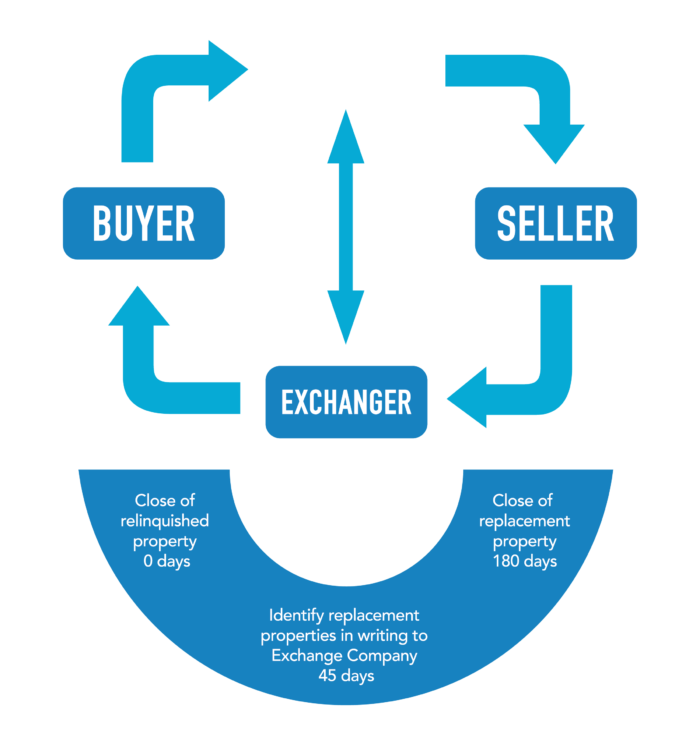

You may have been thinking this entire article was slated for doom and gloom. But, what if there were a way you could defer those taxes and continue building your portfolio, tax deferred? Section 1031 of the federal government’s tax code permits a seller to complete a like-kind exchange (real estate asset to real estate asset) in which a replacement property is purchased within 180 days. Completing a 1031 like-kind exchange, often referred to as “1031” or “like-kind exchange,” allows you to roll all of the proceeds of your sale into a “like-kind” asset.

In the sale example used above, a 1031 exchange would allow you to roll the $500,000 into another asset without paying the $119,000 in capital gains tax. Over time, this strategy could allow you to “scale up” into larger assets public, in broad strokes, on the subjects of capital gains tax and 1031 exchanges that produce greater cash flow and potentially greater returns. Completing a 1031 transaction requires the participation of a real estate attorney who specializes in that process.

Please remember to consult your accountant and real estate attorney to better understand your personal options.